Award-winning PDF software

How to prepare Form W-2G

About Form W-2G

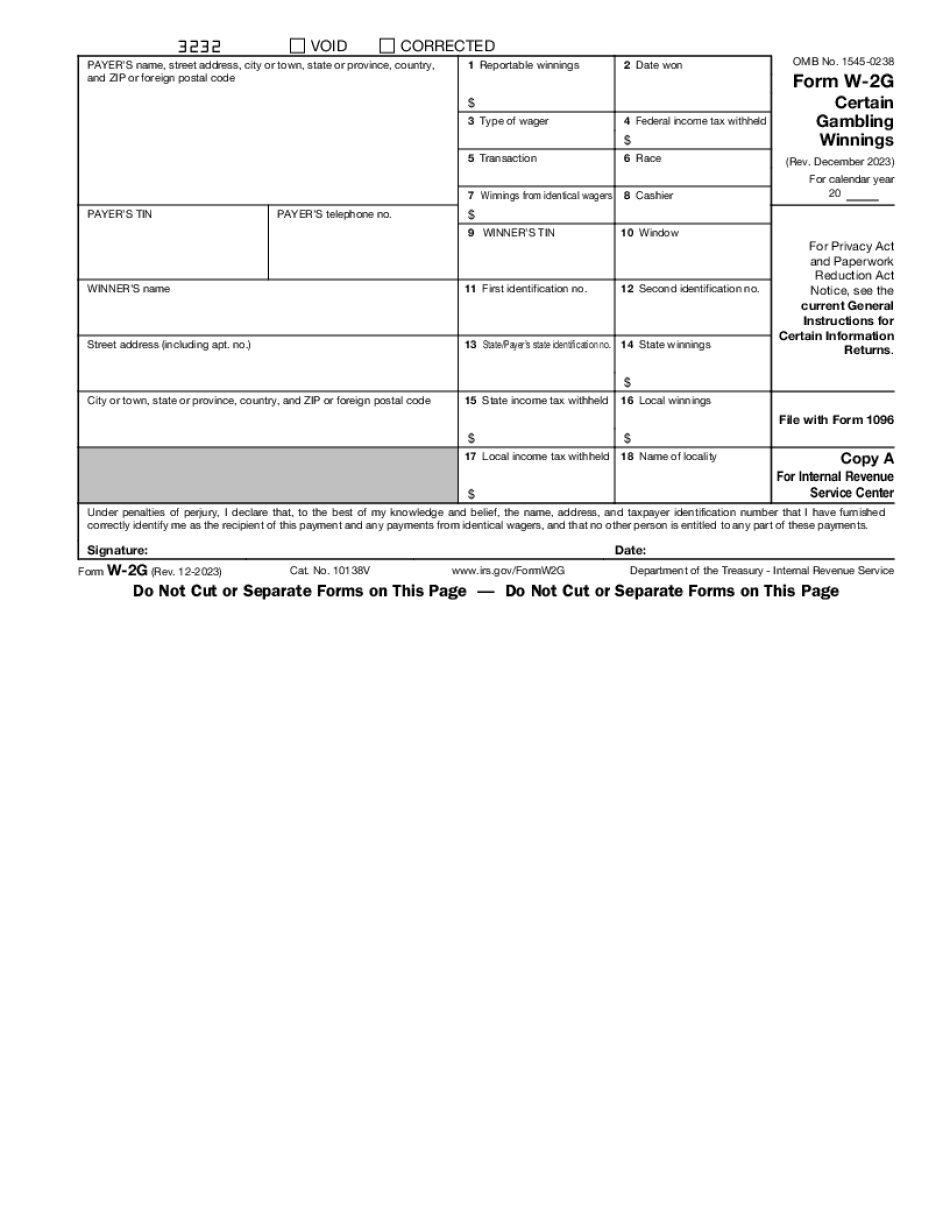

Form W-2G is a tax form used by the Internal Revenue Service (IRS) in the United States to report certain gambling winnings. It must be completed by casinos and other gambling establishments that pay out winnings to individuals. Individual taxpayers who receive gambling winnings of $600 or more from lotteries, raffles, horse races, dog races, casinos, and other types of gambling need to receive a copy of Form W-2G. The form is used to report the amount of winnings and any taxes withheld from the winnings. The taxpayer must then use the information on the form to accurately report their gambling winnings on their federal tax return.

What Is Irs Form W 2g pdf?

Online technologies allow you to to arrange your document management and enhance the productivity of the workflow. Follow the quick information so that you can fill out IRS Irs Form W 2g pdf, stay clear of errors and furnish it in a timely manner:

How to complete a win loss W2g Form site muckleshootbingo com?

-

On the website hosting the form, press Start Now and go to the editor.

-

Use the clues to complete the relevant fields.

-

Include your individual information and contact information.

-

Make certain that you enter right information and numbers in appropriate fields.

-

Carefully review the content of the form as well as grammar and spelling.

-

Refer to Help section should you have any issues or address our Support team.

-

Put an digital signature on the Irs Form W 2g pdf printable while using the assistance of Sign Tool.

-

Once document is finished, press Done.

-

Distribute the prepared blank by means of email or fax, print it out or save on your gadget.

PDF editor enables you to make changes towards your Irs Form W 2g pdf Fill Online from any internet linked device, customize it in keeping with your requirements, sign it electronically and distribute in different approaches.