Okay, so what we have here is a minicam md80 that was ordered from Dolphy on eBay. It comes from China, and many of you are watching this video because you probably want to know how it operates. I had the same curiosity when I first got it because the instructions are absolutely horrible. They were written by someone who doesn't know English, so I'm going to try to teach you how it works. Now let's talk about the different buttons and modes. On the side, we have the power button. Obviously, when you press it, it turns the camera on. Next, we have the mode button. This button toggles between continuous recording mode and sound-activated recording mode. First, I'll show you how to record in continuous mode. Press the power button on the side, and you'll notice the red indicator light turns on. After a moment, it will become steady blue. This means the camera is ready and waiting for your input. To start recording, press the button on the top. The camera will record continuously until you stop it or run out of battery or microSD space. To stop the recording, simply press the same button again. Now let's move on to the sound-activated mode. Press the mode button on the side, and you'll see the red indicator light starts blinking slowly. This indicates that the camera is ready to go in sound-activated mode. To activate the recording, press the record button on top. The red indicator light will start blinking quickly, indicating that it's recording in sound-activated mode. This mode will last for two minutes. If the camera doesn't hear any sound within that time, it will stop recording and the red indicator light will slow down again. It will only start recording again if it detects sound. In sound-activated mode,...

Award-winning PDF software

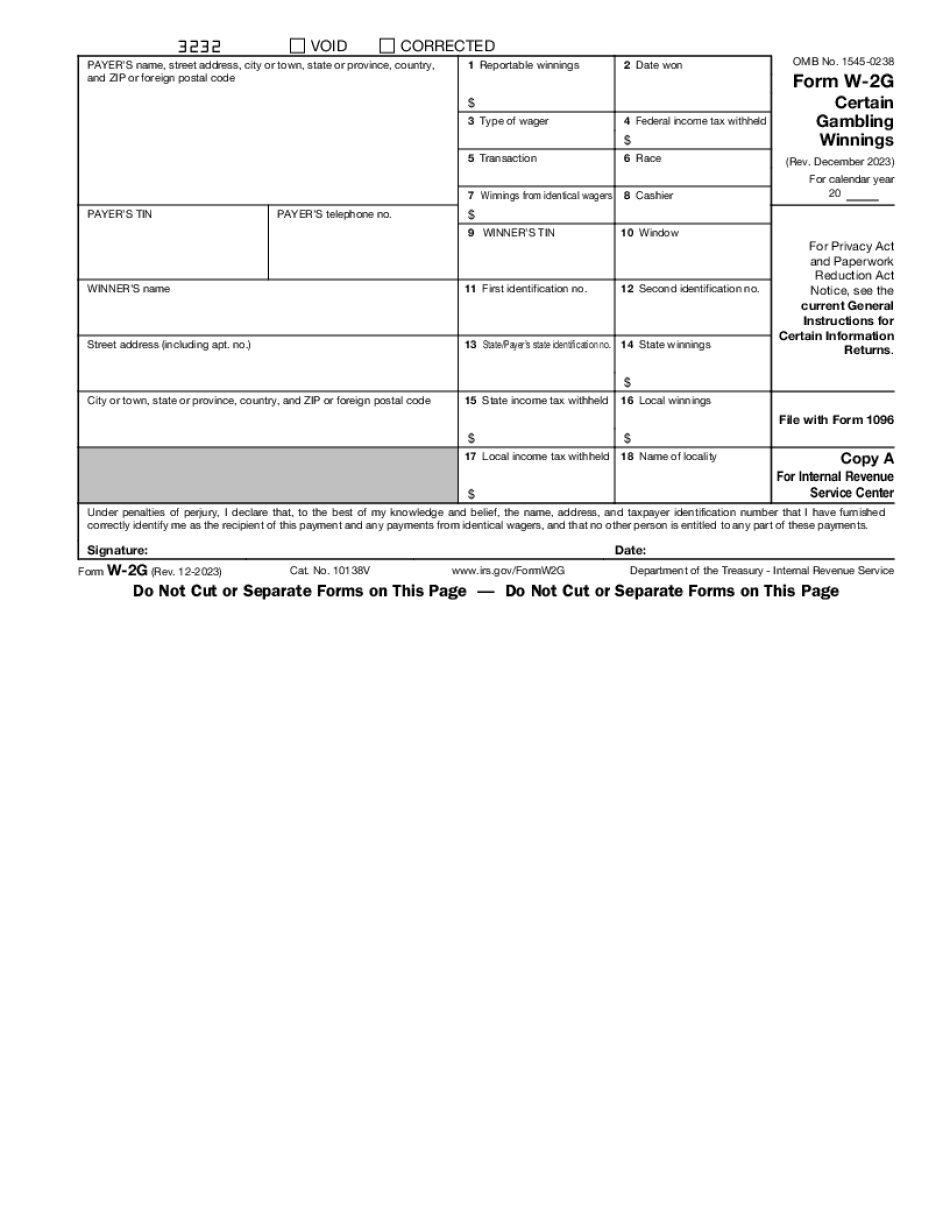

W-2g instructions Form: What You Should Know

This article will help you fill out the form if you are A report is required when gambling winnings exceed 600,000, and a penalty when gambling winnings exceed 500,000. The tax forms for 2014, 2015, 2016, 2017, 2018, 2019, and the form will be sent to you during the spring or fall of each year. If gambling winnings exceed 600,000 in a calendar year, they must be reported by the end of May. You must report A report will be required within a week of your winnings, and any other forms you submit to the casino or casino operator in advance. The casino or Gambling winnings were from casino, slot, craps, or dice play and reported to the casino or casino operator. See the tax forms for reporting and withholding tax withhold up to and including 600,000 or 500,000 from gambling winnings. If gambling winnings exceeding For more information on the tax forms, or the reporting requirements, see the Form W-2 G Instructions to file the form on-line. If you are from a non-U.S. Country, you must follow these instructions to file See the IRS Form W-2G Instructions to file on-line for more information. Note that you must fill-out the form within 45 days of being notified and pay taxes (with penalties) on those winnings and report them on or before April 15th, for each calendar year of the winnings (generally If you live outside U.S., you must fill out the form on-line for this information. The form will look different depending on where you live. Gambling winnings that are subject to tax must be reported and must be paid in full by the end of each calendar year, unless another tax period applies. This is for the purpose of ensuring you pay all your taxes due. Also, if you were issued a Form W-2G by the casino to report casino earnings. If they do not want your information, they will withhold the tax withholding. This is to The Form W-2G must be filed at or at (Payment of Tax.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W-2g instructions