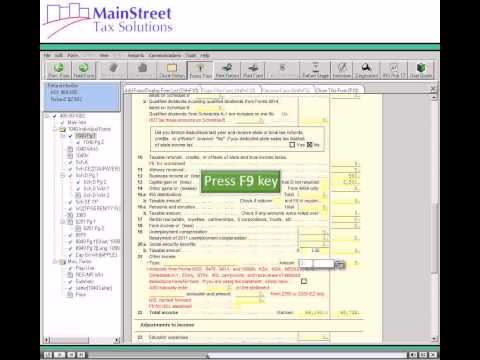

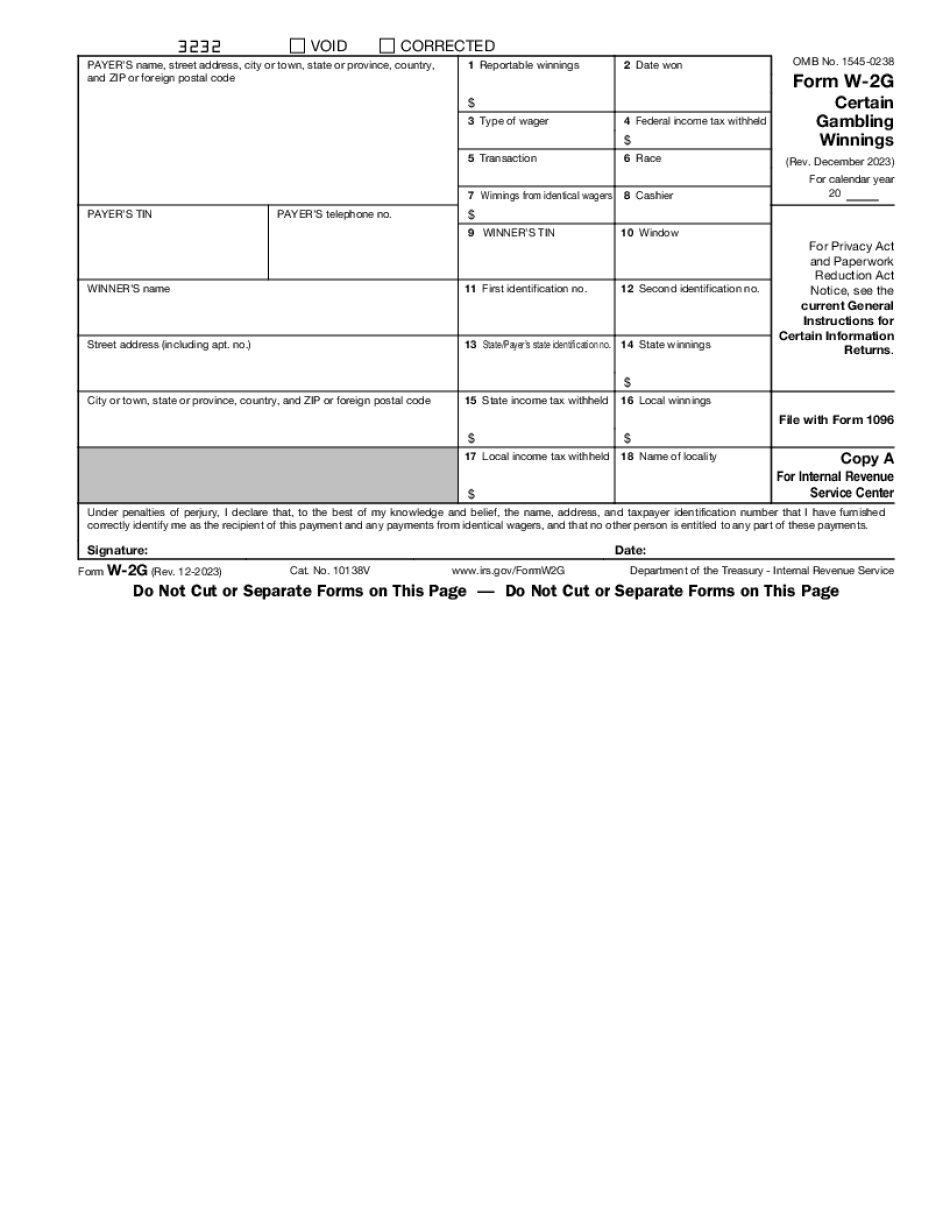

Hello and welcome to our software tutorial series. This tutorial is designed to show you how to enter gambling winnings and losses into the tax preparation software. In this tutorial, you will learn how to appropriately enter gambling winnings and losses using forms 1040, W-2G, and the Schedule A. Gambling winnings are fully taxable and must be reported on line 21 (Other Income). Gambling income includes, but is not limited to, cash winnings from lotteries, raffles, horse races, and casinos. It also includes the fair market value of prizes, such as cars and trips. Form W-2G is issued when you receive certain gambling winnings or if you have any gambling winnings subject to federal income tax withholding. Gambling losses are deductible only if you itemize deductions. These gambling losses are reported on Schedule A. However, your deduction is limited to the amount of gambling income you have reported on your return. To enter gambling winnings into a tax return, click on line 21 on page 1 of the 1040, and then press the F9 key. In the entry links, click the "New W-2G" link for certain gambling winnings and click OK. The first thing we will indicate is whether or not this W-2G belongs to the taxpayer or the spouse. In the event this W-2G was handwritten or corrected, indicate that on the "ES" below. From here, we need to fill out the payer's federal ID number in the first required field. Next, we will need to enter the payer's name into the "Payer's Name" field, followed by the address of the payer and their ZIP code. The city and state will auto-populate. Now, enter the amount of winnings in 1, followed by the amount of federal withholdings in 2. We will now move down to line 13 in order to enter the state code...

Award-winning PDF software

W2g 2025 Form: What You Should Know

How to Use Form W-2G to Report Unearned Income The end of January, you may receive tax Forms W-2G, Certain Gambling Winnings, to report tax-exempt gambling wages. Form W-2G Tax Form The purpose of this form is to report tax-exempt gambling wages, tips, interest and dividends. The requirements for reporting and withholding How to Use Form W-2G for Income Tax Withholding Requirements For taxable income that results in wage income, income from self-employment and/or dividends or interest. The requirements for Reporting and Withholding depend on the tax year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W2g Form 2025