Music it's time to get down to the brass tacks my name is Mel Samms and I'm the managing associate of Sam CPA and today I'd like to talk to you about gambling incoming losses as modified by the tax cut and Jobs Act of 2025 now this was an area of the tax reform that's been often overlooked but I find particularly interesting because it kind of goes counterintuitive to some of the main tenants of the tax reform whereby businesses and their owners get additional benefits the effect on gambling has kind of gone the other way and I'll explain what I mean by that prior to 2025 typically if you were a recreational gambler let's call it that you you go to the casino from time to time you wager lottery tickets whatever sports betting which is now legal in the becoming legal in the US per Supreme Court decision but this recreational gambling meaning that you did not do that for your primary revenue source recreational gamblers were able to deduct gambling losses if they itemize their deductions to the extent of their gambling winnings and they had to provide substantiation for those losses meaning if you wagered $2,000 in a slot machine and won 1500 back you would receive a w-2g in the amount of $1,500 but then you would be able to take $1,500 of gambling losses to offset now that extra 500 would just disappear it was a personal expense not deductible anywhere but it was limited to the cost of the wager the money you put in the slot machine the money you paid for the lottery ticket that initial wager and professional gamblers to the contrary before 2025 those people who met the very narrow definition of a professional gambler who...

Award-winning PDF software

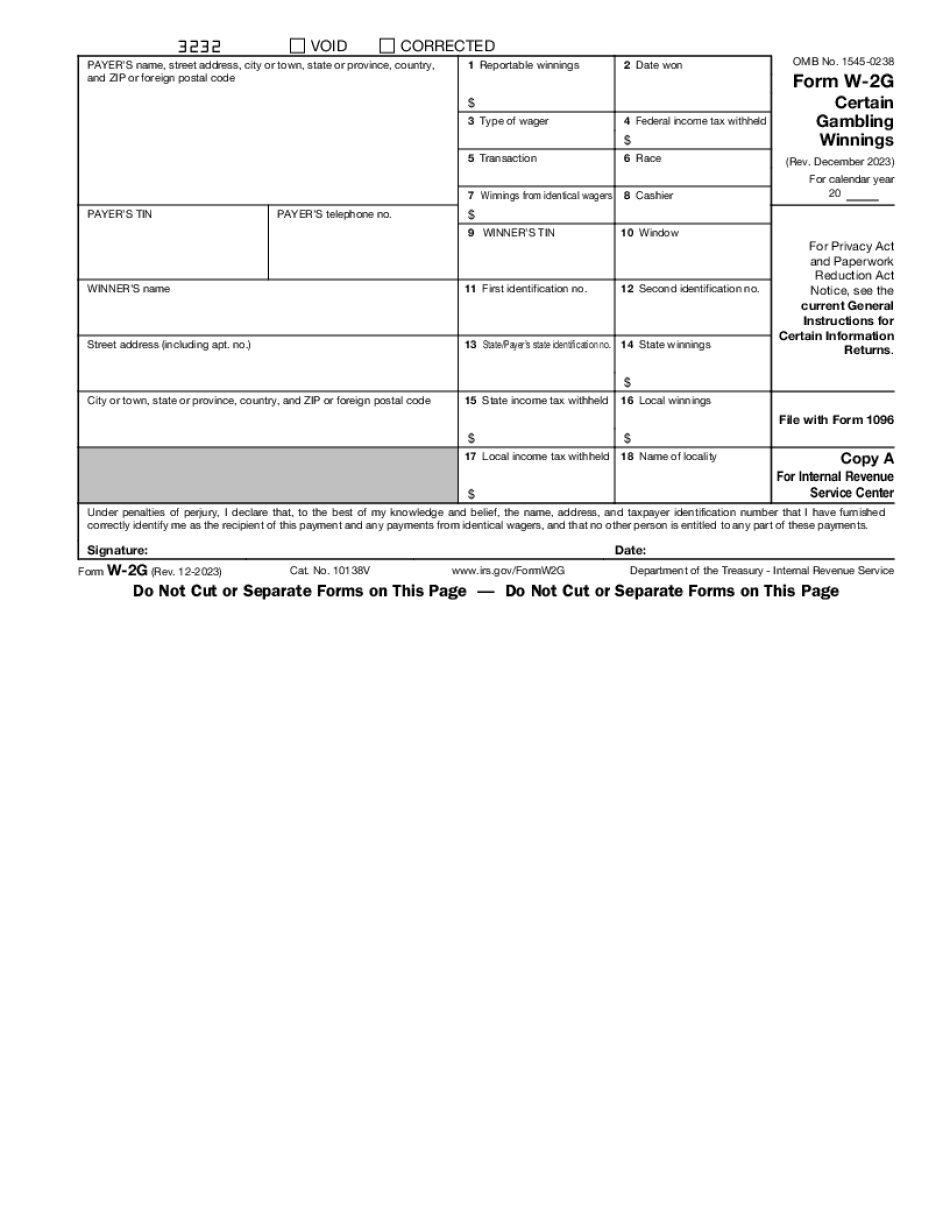

W2g 2025 Form: What You Should Know

The purpose of these forms is to report or withhold gambling winnings and any federal income tax deducted therefrom. The requirements for reporting and withholding depend on:. The 2025 Tax Rates for Individuals The 2025 tax rates will be effective beginning on January 1, 2018, and will affect income earned through the end of 2018. The tax rates also were indexed for inflation until December 31, 2019. If you have not yet determined if you filed a tax return for the 2025 tax year or need a quick reminder, check out the 2025 tax rates. As you may already know you will need a W-2G to report the gambling winnings on your tax return. This form is also used by casinos to report these earnings to the IRS in 2017. The IRS uses the tax form to determine the winnings and any federal tax withheld from the amount. 2018 Tax Rates on the Margin Income of 400 or more on which no income tax has been withheld will be taxed at 10%. Income of 200 or more on which 5 of federal income tax withholding has been withheld will tax at 15%. Income of 100 or more on which no federal income tax withholding has been withheld will tax at 25%. Other income that is not included above may be taxed at rates higher than 10%, or in the case of the first 5 of federal income tax withholding, 50% of the amount withheld. The 2025 Casino License Tax Rates You will be taxed a 5% slot machine license use tax, plus a 0.07% tax on the casino's net gambling income from gaming. Casino operating and maintenance costs include but aren't limited to, security, maintenance and security guard salaries. The casino uses the casino's profit margins to calculate the tax rate for these costs. As far as tax withholding go, gambling winnings are reported at 25% and federal Income Tax withholding from those winnings are reported at 10%. Other than that, casinos have no other income to withhold from winnings and pay withholding tax at a 10% rate. The 2025 Nevada Gambling Tax Rate Nevada casinos pay an additional 5% on the gross gaming income they receive from gaming facilities. Gross gaming income is gross casino income plus the amount of casino license fees and the total of all expenses and taxes paid for casino-related gaming operations and operations of the facility (i.e., property taxes, utilities, and employee welfare contributions). This amount may exceed the gross profits that casinos actually earn from gaming.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W2g 2025