Award-winning PDF software

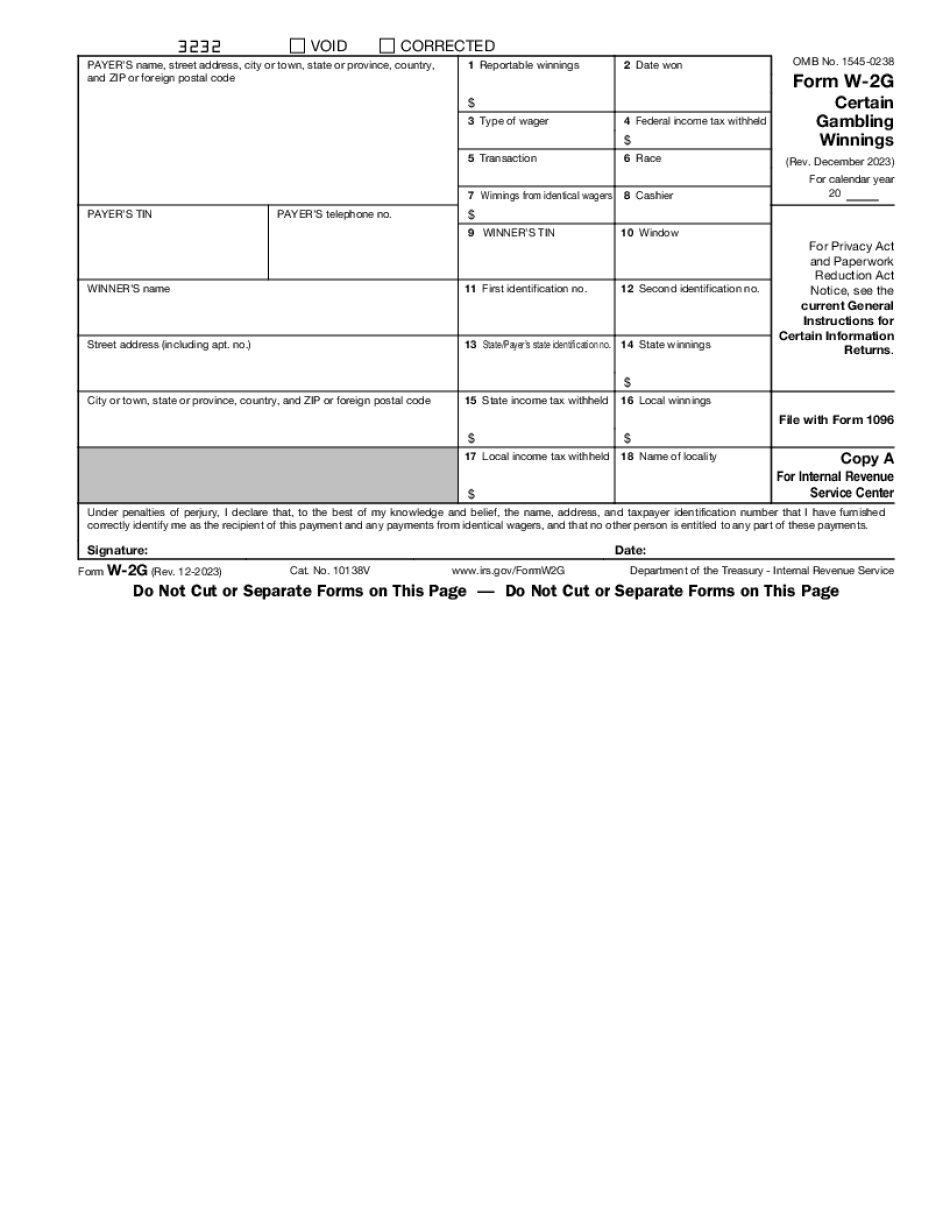

Irs w-2g 2025 Form: What You Should Know

Form 1563-G, Notice of Federal Income Tax for the Current Year — IRS to report those gains or losses. But most people are waiting for the return for their 2025 calendar year income tax. By Dec 31, 2021, you need to start collecting tax from your winning wager. If you can't wait, here's advice from John Bonsai of Bonsai Strategy Group and former CEO of the Financial Services Roundtable. “When you've paid a tax and gotten that letter on Dec. 31, 2018, it's going to make your day,” said Bonsai. The W-2G and 5754 forms are used to report income for year 2025 by casinos and horse tracks. However, you can use the forms to report all kinds of winnings, from lottery profits to your favorite online poker game. The Form W-2G is also used when you bet online poker directly from your Internet browser. “The only difference is I paid a fee on the W-2G, but the W-2G is designed to file electronically,” said Paul Van Duse with Casinos Anonymous, a Las Vegas-based nonprofit organization. “I've never seen a W-2G on the table, except it says 1099-G in the signature line.” Even if you don't have a casino in your home state, you're liable for federal income tax If you play online poker or other gambling games on your web pages, that work is not taxed You report your winnings on a Form 1099-G, W-2G Your winnings are taxable If your wager isn't reported on Form W-2G, the federal government still will take tax off your winnings. “You have to report your winnings by Jan. 31, 2019,” said Van Duse. “It's very simple.” The IRS said you may have to file a backup tax return if the federal government fails to collect money from you. That's a common occurrence when it levies tax on gambling winnings. A backup return can include all the usual forms you file with your regular tax return. The W-2G is the only tax you have to file The only way to report online gambling winnings is with a W-2G.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.