Award-winning PDF software

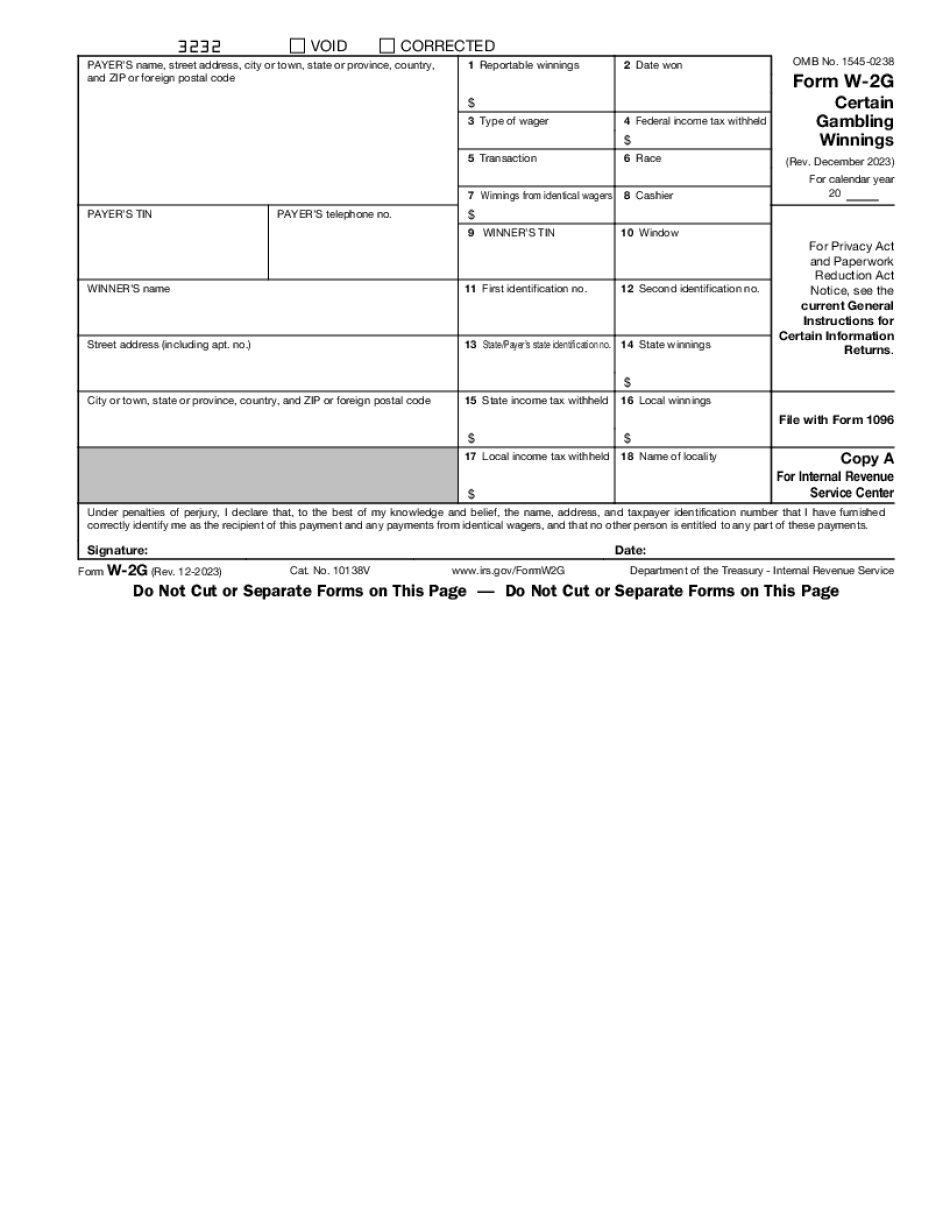

w-2g 2025 Form: What You Should Know

How to Calculate the Amount of Winnings You May Receive Aug 16, 2025 — You are a resident or non-resident of the U.S. and winnings from gambling in the U.S. are taxable. The following chart gives the annual tax brackets for most gamblers and the tax rates paid on a 50/50 split of the casino winnings, depending on the amount wagered. Note, you may have to take into account federal taxes when you are depositing the winnings at the casino. As you can see, an income of up to 3,500 may qualify as a non-taxable gambling win. An individual who has a taxable income exceeding the first 2,700 of their taxable income may be taxed 0 on winnings if they work in their home country and meet certain other conditions before the month of their first gambling trip. For the purposes of the 2,701-and-greater rule of gambling winnings, each 1,000 in winnings is split in half between the winnings and gambling expenses. Form W-2G Certain Gambling Winnings — IRS Dec 10, 2025 — As casinos and the IRS adjust some rules applicable to casinos, it's often useful to use the IRS gambling expenses calculator to estimate the amount of your winnings that may be deductible. Sep 3, 2025 — The casino has been operating for a given amount of time for a given amount of tax year. The amount of the gambling expense paid for the prior tax year is used to determine the gambling winnings, whether in cash, bonds, mutual funds, stocks, or some other form of betting. The casino's adjusted operating expense is an additional itemized deduction to the gambling winnings figure. Sep 3, 2018—The tax year ended on September 30 for the preceding tax year. The prior tax year's gambling winnings figure used as a basis for the tax year following, even though the tax year has ended. Sep 3, 2018—The taxpayer's adjusted gross income for the preceding tax year is shown on Schedule O. The prior year's adjusted gross income is used as a basis for the future tax year. The tax year's taxes paid on the prior year adjusted gross income are deducted as a separate itemized deduction on Schedule A.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.