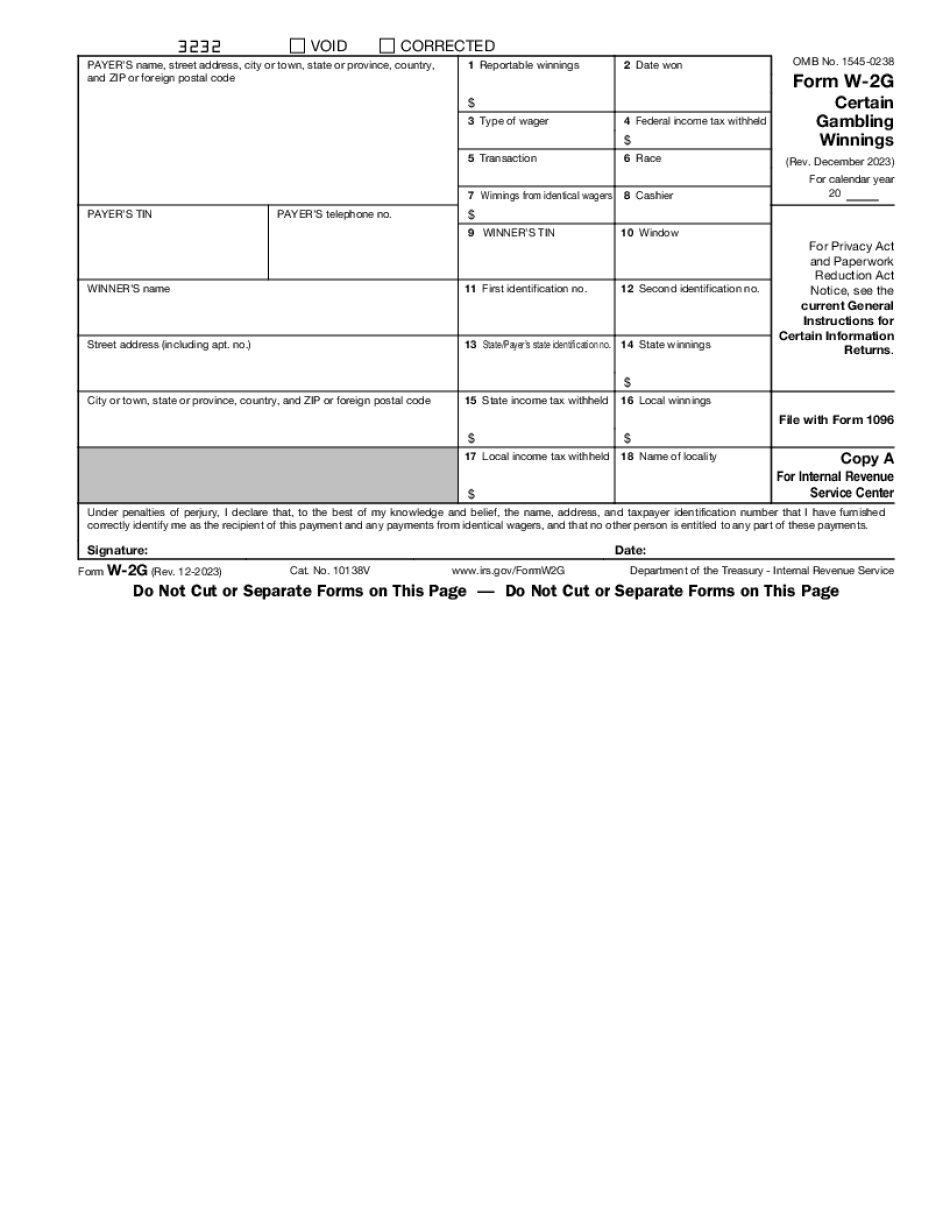

Hi my name is David Miles I'm an enrolled agent with 20/20 tax resolution and today I'm gonna discuss how often gambling winnings or losses are audited by the IRS the short answer is probably no more often and maybe even less often than many other issues such as whether a taxpayer is self-employed or a higher earner unfortunately the IRS doesn't publish numbers on specific audit issues the most common issue relating to a gambling audit is a document matching matter what that means is if you have gambled and earned more than $600 the payer or casino is required to issue a w-2 G that form will be sent to both you the taxpayer and the IRS if you fail to report your w2 g and its income on your 1040 tax return it's very likely that it will prompt a letter from the IRS traditionally these audits are done by correspondence not office visits or face-to-face meetings and they're very easily reconciled remember you should always consult with an enrolled agent or other qualified tax professional about your specific situation my name is David miles and those are my thoughts on how often gambling winnings or losses are audited by the IRS thanks for watching you.

Award-winning PDF software

W-2g Form: What You Should Know

W-2G income, the amounts you are reporting, the category(s) you are reporting, and the years of the individual reporting. There are limits on how much you must report. The filing deadline is March 15. What Is Included on Form W-2G: How Much Is Required to Reported and How Much Isn't? Tax Definition of “Certain Gambling Winnings” — Form W-2G Do you find it challenging to find out how much gambling income an individual has? You may need detailed instructions for some fields. For instance, on the Form W-2G, you will probably need to report gambling winnings that are at least 2,300 per year. If you don't report such winnings, the IRS may not include them in your tax return. Do Other Form Count as the W-2G and W-2G-EZ? Form W-2G: Certain Gambling Winnings — Investopedia Form W-2G should be used for reporting all gambling winnings from gaming machines. It should not be used to fill out a form to report gambling winnings from any other sources, such as lottery tickets, video games, and casino winnings. Form W-2 for Gambling Winnings Report Gambling Winnings to the IRS — Businesslike Form W-2G is also used for reporting casino winnings, which are taxable. To report gambling winnings on a Form W-2G, you must enter your gambling winnings in box 3 and enter your gross income after taxes in box 15. If you do not report your gambling winnings, then these winnings are not subject to tax. When you are filing Form W-2G for the first time, you will need to fill out Form W-2G-EZ (Employer's Quarterly Federal Tax Return). You may find it helpful to find out how much tax you would owe in a different tax bracket before you report your income. Also, find out how much you may owe if any of your taxes are underreported. If you have any questions about this form, or you still need help with a federal tax return, call one of the best tax help companies in the business.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-2G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-2G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-2G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-2G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W-2g form