Award-winning PDF software

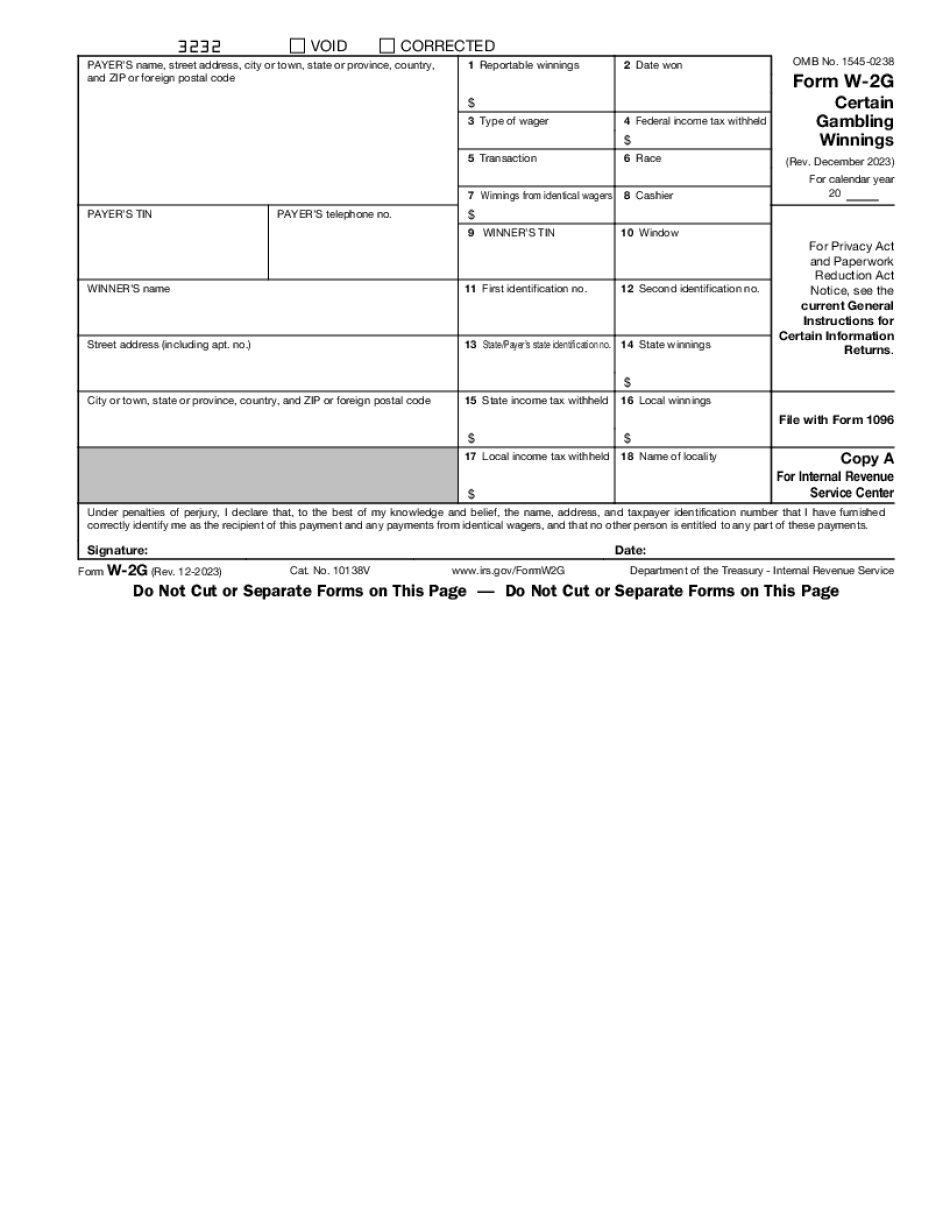

Printable Form W-2G San Angelo Texas: What You Should Know

Fees — San Angelo State University The San Angelo State University has increased the student employee fee by 60 annually. The increase takes effect August 1, 2018. The money raised from the increase will go towards student tuition, and the increased fee will also reduce the amount of a student employee fee that the Tax Office may charge a taxpayer. The tax office will not be able to waive the Student Employee Waiver Fee as a result of the increased student employee fee. Form W-2G, Certain Gambling Winnings — IRS The requirements are very specific and if someone doesn't follow the law, we can have the IRS throw them in jail. If we need to file a Form W-2G with the IRS to report gambling winnings then we need to follow these strict rules. Form W-2G (Rev. January 2019) — IRS The IRS changed the law regarding how the IRS and the Department of Labor share data for W-2 Wage and Tax Statement. This new law affects whether we need to file a W-2G. About IRS Form W-2G, General Instructions — IRS Filing a W-2G does not save us from paying taxes as long as we withhold enough tax to satisfy FICA withholding for that tax year. The IRS Form W-2G says “all persons who are employees” or “all other employees.” In this case only our employees are taxpayers. So, the tax laws are being enforced against our employees, and we will be liable for the law violations. It is also important that we know if anyone of us is a contractor, independent contractor, subcontractor or independent contractor. This may be another reason why we need to file a W-2G. How much do I need to withhold? Form W-2G (Rev. 01/18) — IRS On April 1, 2017, the Federal government began to implement a new tax code, as part of the Taxpayer Relief Act of 1997. You may have noticed that the IRS has changed the tax code for tax year 2025 to the Taxpayer Relief Act of 1997 (which was passed after April 1, 2017). This new tax code allows you to file tax forms (which are actually 1040Xs) and pay your taxes online or by telephone with a 1099 form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form W-2G San Angelo Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form W-2G San Angelo Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form W-2G San Angelo Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form W-2G San Angelo Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.