Award-winning PDF software

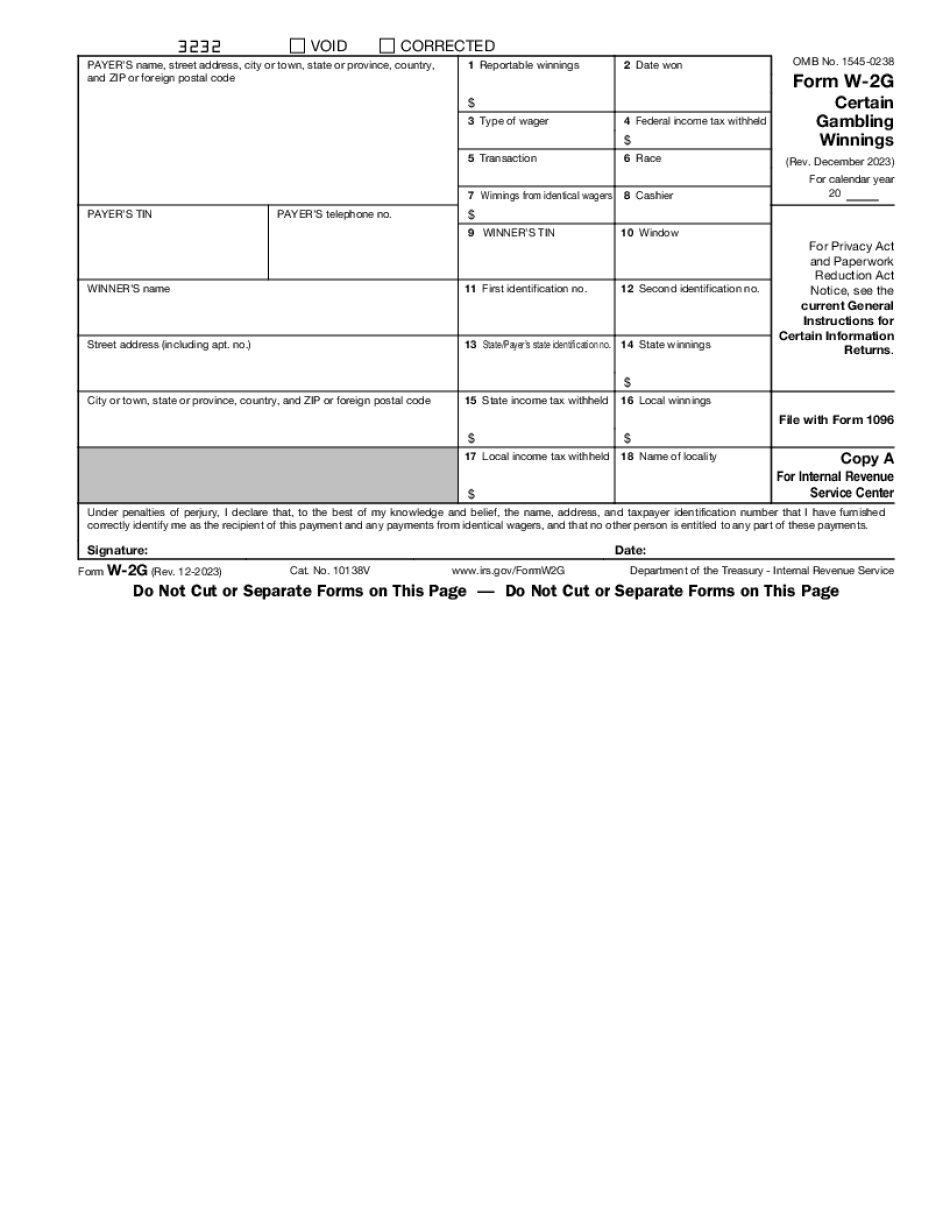

Form W-2G Houston Texas: What You Should Know

Enter your federal taxes withheld and your state taxes for the taxable year. The total shown in box 4 of each form. For 2017, include all federal taxes (box 4) and state taxes (box 1) on lines 1a through 1f and file the return electronically using the Texas Online Taxpayer's Filing System. After you file your return, provide it to your tax preparer for filing by mail. You will be sent a paper copy of your return and instructions for completing your free Texas State Guide to Personal Income Tax Withholding. If your federal income tax withholding is zero, you may be able to save money on state and local income taxes by using the free Texas Guide. Use the free online Texas tax prep software, Texas FILE Online, to file your return at no extra cost to you. If you file electronically at least once per year, your state income tax will be ready in minutes after you log in. Your state will automatically calculate, add, and send the right amount of state and local income tax as soon as your return is received. If you need immediate filing assistance, please call in Texas. The state of Texas requires all filers to provide a Texas tax identification number (TIN) when filing a federal tax return. If you have multiple federal tax returns that are due in Texas, you will be required to provide proof of identity to your state tax officials when filing state tax returns. (Note: If an applicant doesn't have a TIN, and the IRS thinks otherwise, the IRS may refuse to process its refund.) The Social Security Administration (SSA) requires state tax filers to verify their SSA number with the Texas department of income tax prior to refund or credit processing. SSA will require a social security number, if the Texas department of income tax requires it. You are welcome to contact us and talk about how we can help you with all your Federal tax questions. If you use your personal email address, we'll be sending out a confirmation link to that address. If you would rather talk on the phone, please give us a call at. Tax Law Changes Since 2018 We have many changes to the Tax Law since we began publishing. One of the following changes may affect your situation after April 20, 2018. The one you receive may have occurred after our deadline. To learn more about our tax law changes, Click Here.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2G Houston Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2G Houston Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2G Houston Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2G Houston Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.