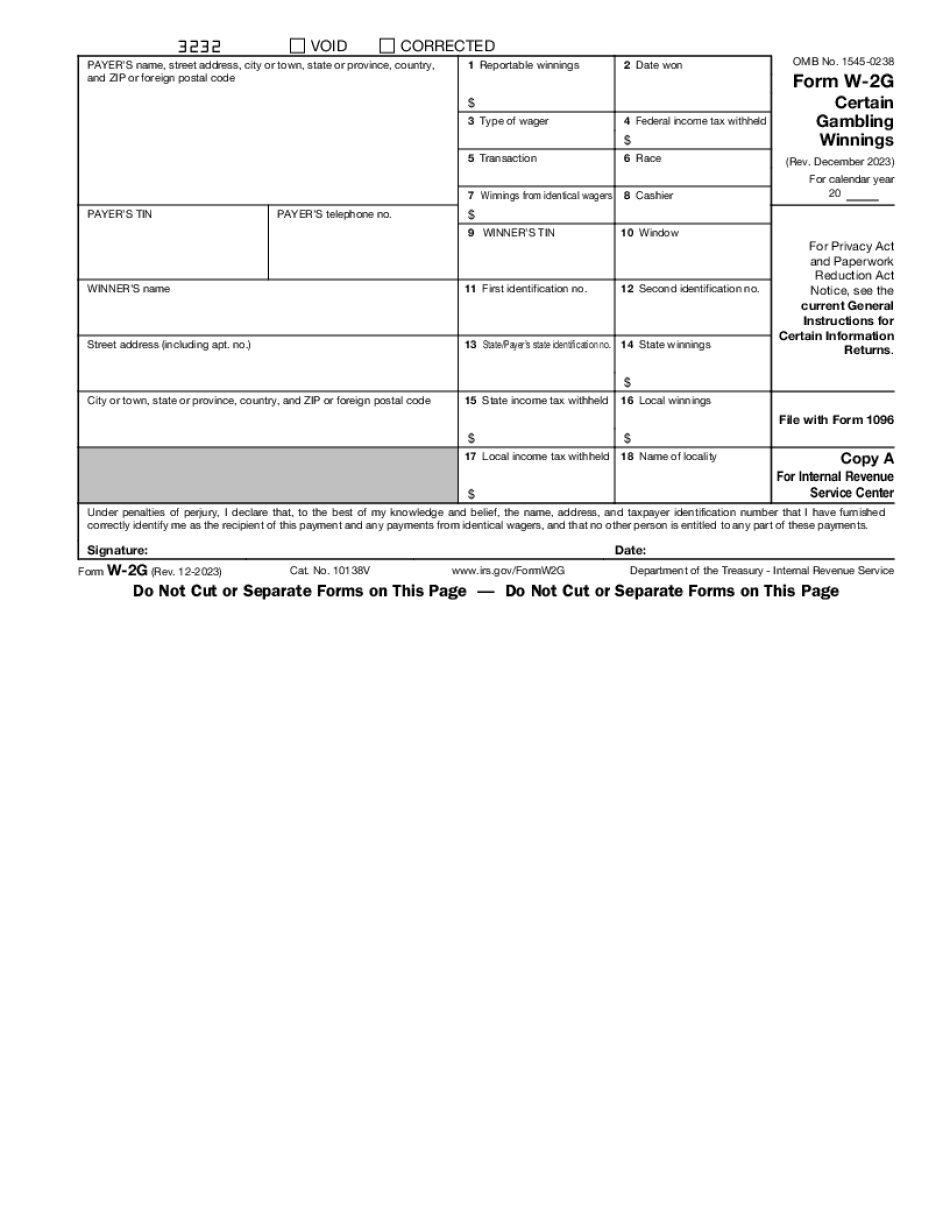

Okay so for this video i wanted to talk about how to report your gambling winnings and losses on your form 1040 tax return um and so what we're going to do here is we're going to we're going to go through a form w 2g example i've also got a sample form 1040 where i'll show you how this actually gets reported on the return on the 1040 on schedule 1 on schedule a and then i got a simple fact pattern in front of us that we're going to use to build out the return so just to start with high level u.s taxpayers are required to report gross income from whatever source derived so if you win money gambling that is gross income that must be reported on your tax return you must pay taxes on it um and so that's the kind of the short answer that people don't like you here but it's the truth now if you gamble regularly you report all your gambling winnings but you can also report gambling losses to the extent of your winnings so what that means is if you have gambling winnings you can report the losses to offset those winnings you can never report more losses than you have winnings right so you can't take a net gambling loss but at least you're able to offset the two so you're not paying tax on just the gains you get to offset the losses that you might incur as well now a little unique uh nuance to that role though however is for individual taxpayers you can only report the losses if you itemize deductions so i'm going to go over those rules we're going to look at this example first i'm going to show you how that...

Award-winning PDF software

Video instructions and help with filling out and completing Form W-2G vs. Form W-2c