Award-winning PDF software

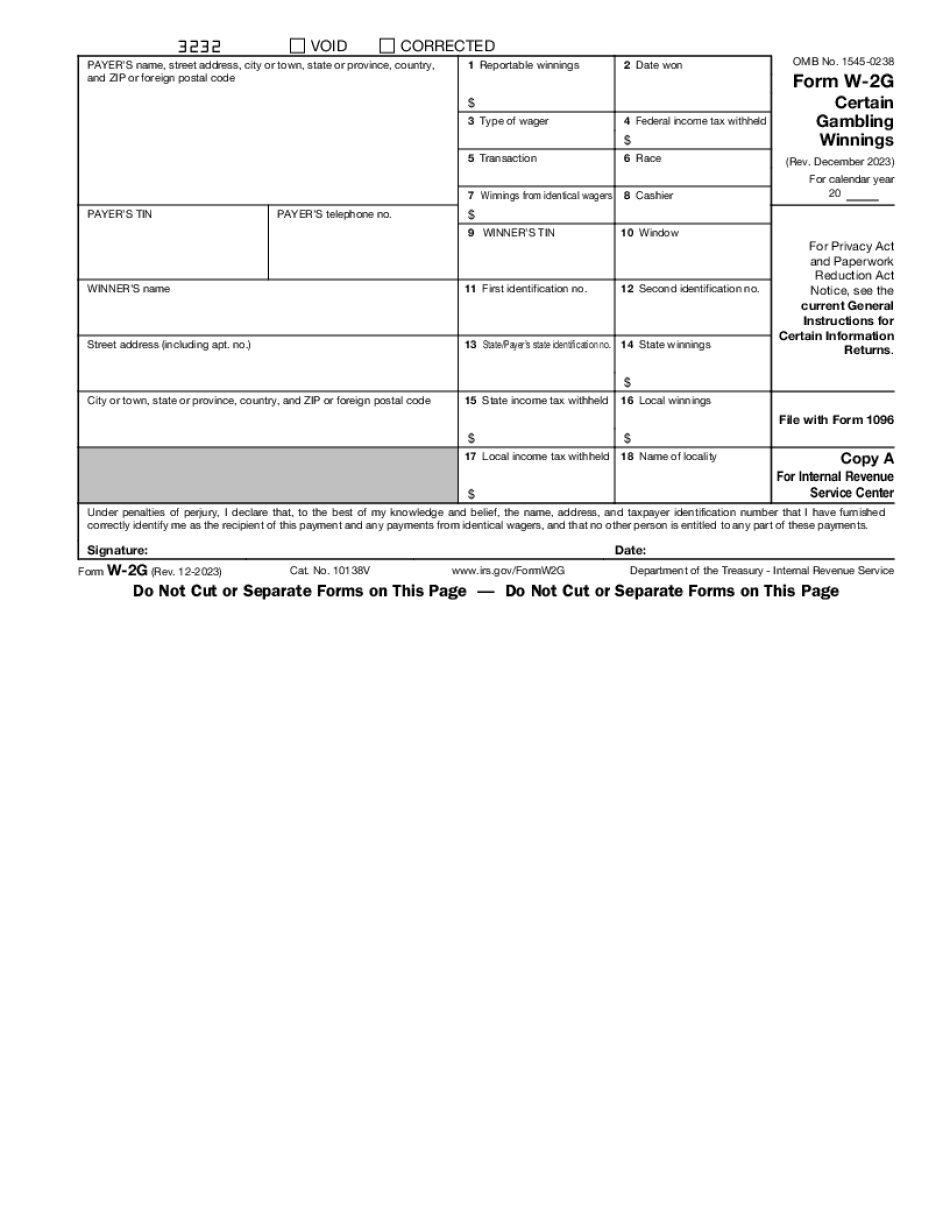

KS online Form W-2G: What You Should Know

You must complete this form to report any winnings received with respect to which a cash or in kind or electronic check or cashier's check was dishonored due to tax withheld, and which do not result from the bona fide exercise of a profession, business, or occupation or for tax or political reasons, provided that the person is not a Federal public official as defined by section 11 of Title 26. Forms W-2W, W-3F, W-4, K-2, W-4G and C-2 do not apply to persons, but are available if they are required for reporting wage income (as defined by section 3662(a)). Kansas Form W-2 & KW-3 Form — H&R Block Form W-2 & KW-3 Filing Requirements — Bandits E-file Form W-2 directly to the Kansas State agency with Bandits. Check the filing requirements of reconciliation Form Kansas 5754G. Easy to file. Filing Out of State W-2F & K-2 Forms — H&R Block Form W-2F and K-2 Forms —H&R Block H&R Block Form Filing Requirements — Kansas A Form W-2F and K-2 Form must be filed with the Kansas Secretary of State's office in order to report gross wages, commissions or other consideration received for services rendered, gross income, wages or salary paid by any means to any member or manager of any trade (within the meaning of section 5 of Kansas Revised Statutes), or wages or salary received by any owner, president, secretary or other similar officer, director or employee of any corporation in relation to a trade. The Kansas Secretary of State's office determines what constitutes gross income. This documentation also must be filed in a timely manner at the Kansas post office if Form W-2 is being signed. Please note: It is the taxpayer's responsibility to complete and file the form and ensure that the information provided is correct. The person signing W-2 form must have all required items accurately filled in and correctly completed. The person signing K-2 form must be the person in whom the income is subject to tax, that is, the individual or the legal owner of the employer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete KS online Form W-2G, keep away from glitches and furnish it inside a timely method:

How to complete a KS online Form W-2G?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your KS online Form W-2G aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your KS online Form W-2G from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.