Award-winning PDF software

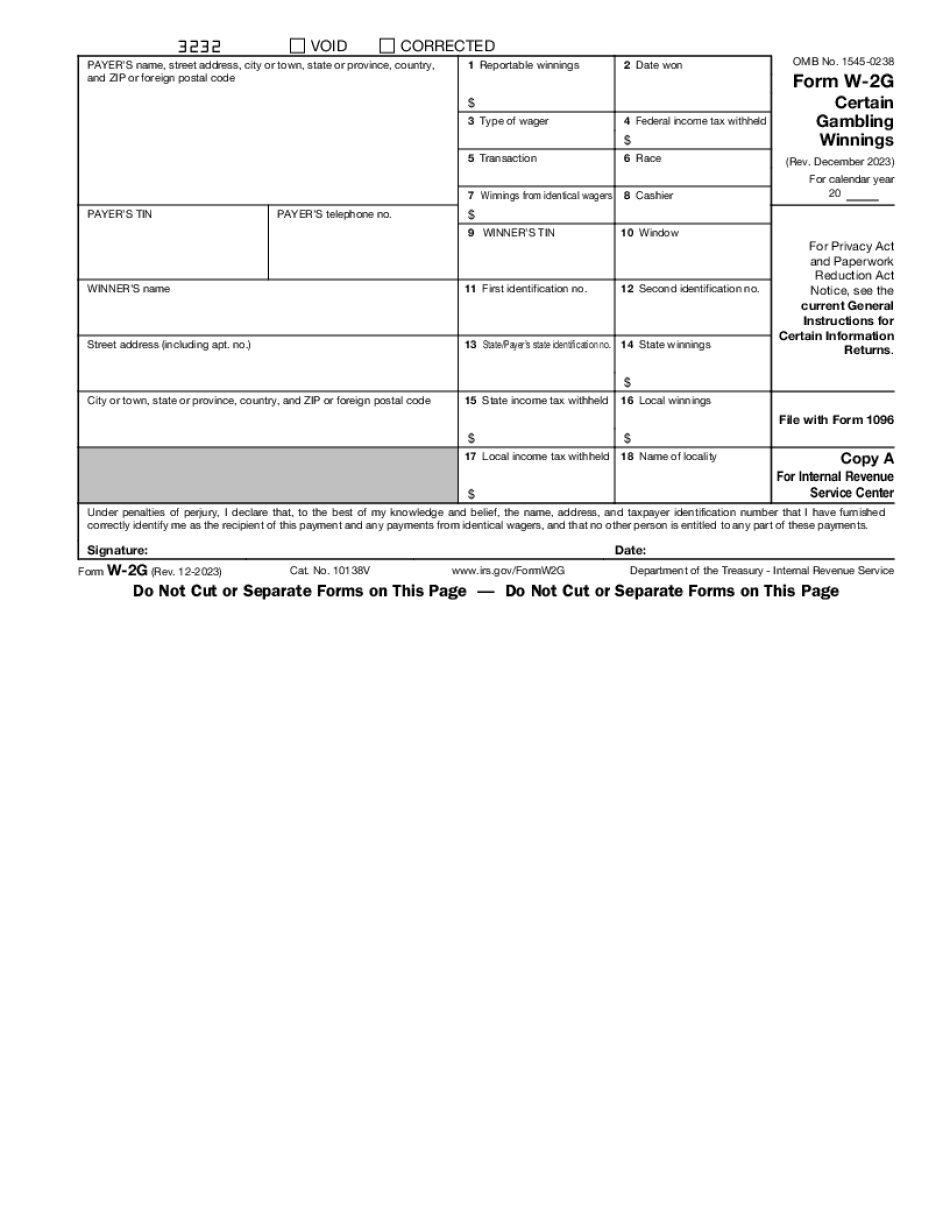

Form W-2G IN: What You Should Know

What's an IRS W-2G Form | Form W2G 2 — Bandits Apr 26, 2025 — This is the last year to File. You can get Form W2G from the IRS any time, but your income may show on your 1040 by April 2025 if your taxable event doesn't occur on April 19. Form 1040 Individual Income Tax Return — IRS You can file Form 1040 and report your gambling winnings on your tax return the same tax year. What's Form W-2G For 2025 — Bandits Jun 22, 2025 — You also need to attach Form W-2G for all gambling profits from April 2025 to the date of your return for the same year. Use Form W-2G to report winnings from your gambling event for the previous year. For example, if you had two events for 10 days that combined for 5,000, you would only need to submit a Form W-2G for one event — 5,000. How to Use Form W-2G For 2025 — Bandits Dec 13, 2025 — The rules change for 2018. For 2018, all federal income tax must be withheld from gambling wage payments unless you are filing Form 8283. For purposes of the 1040, the withholding rate is .10 percent. Thus, the entire amount earned on all gambling winnings paid from Jan 2025 to May 2025 is subject to 1040 withholding. However, a wage payment of less than 800 is not subject to withholding until it is paid, even if you're paying taxes. If you are an individual You can file a wage payment to reduce your federal income tax withholding. The wage payment won't exceed 200 in 2017. You can report the tax withheld on line 30 of Form 1040 or line 14 of Form 1040A. The amount of wages claimed by line 13 of Form 1040 or line 1 of Form 1040A is subject to 5 percent or 10 percent withholding, depending on your filing status. If you would like to claim all or part of a payment you made under the 1040A rules, you must allocate the amount under the 1040A rules. If you don't allocate the payment, the IRS doesn't get any of the money.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2G IN, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2G IN?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2G IN aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2G IN from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.