Award-winning PDF software

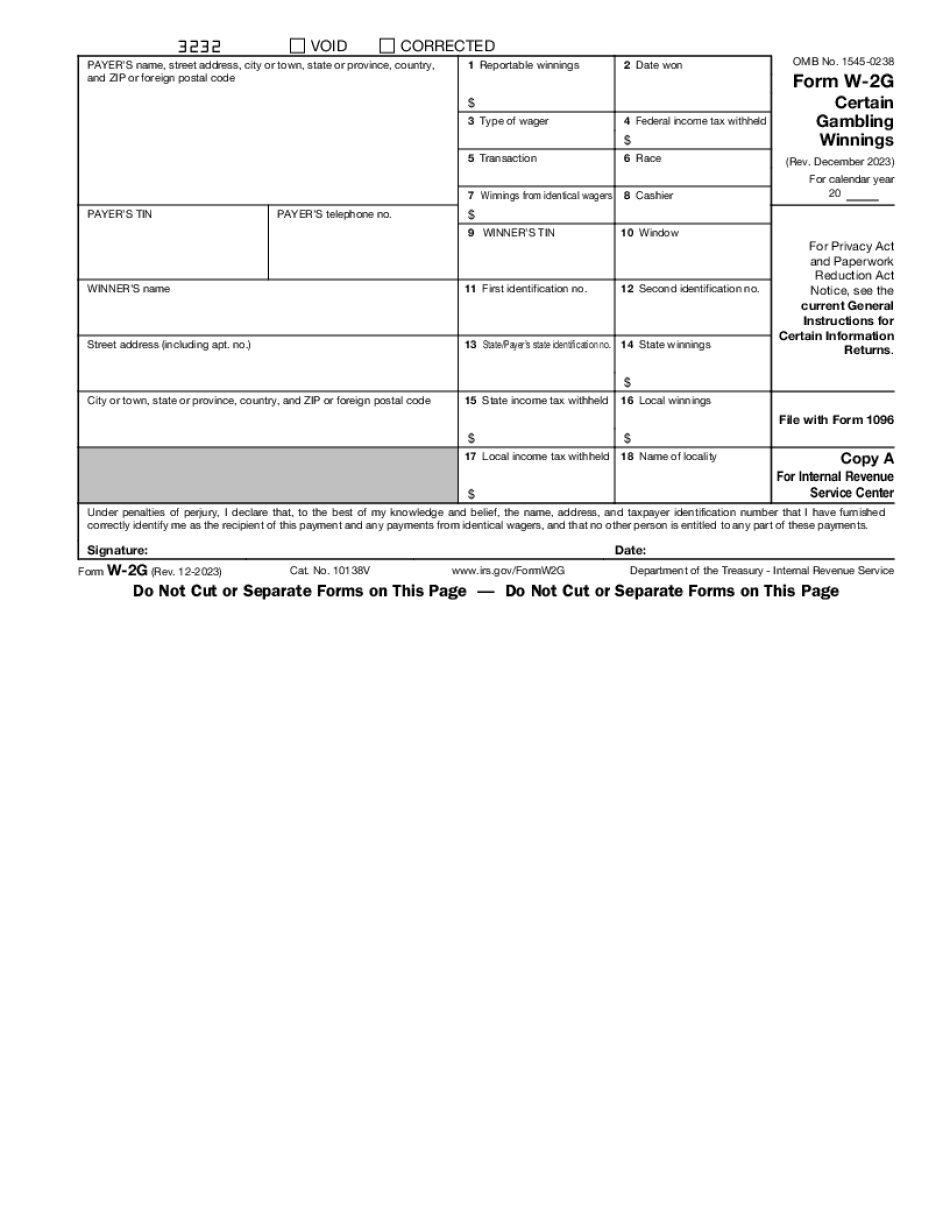

Form W-2G online Philadelphia Pennsylvania: What You Should Know

So, if you win 500 this year, you still need to file a tax return. You also will need to make estimated taxes if you had paid federal income tax on those winnings. For additional information on how to calculate taxes, check out the Pennsylvania Tax Guide. Winning A Lottery In Pennsylvania If you win in Pennsylvania in a lottery, you can deduct the prize that you win and any prizes you win after your first 20,000. If you don't have to pay federal income tax on those winnings, then you just have to report all your winnings in the state, and you've already won. Winning a Lottery Is a Lottery — But the Ruling Is Not If you buy a ticket at a state-run lottery or lottery kiosk, the cashier needs to mark your ticket if it asks for the winner's information. The lottery ticket buyer then fills out a lottery receipt. A ticket for a scratch-off game must also have the winners' information on the ticket. And if the ticket has the winning number on it, the purchaser is asked to report the ticket under the name and address on the ticket. This is important because it may be difficult or impossible for a lottery purchaser to come up with their winning numbers. If you win a prize in a state lottery, report it to Penn DOT as described above. You will not need to file a tax return if your state lottery purchases were in your name, the amount of the prize less the purchase price is 25 or less, the prize was 25 or less in increments of 25, or there was a cash win. If you paid with gift card, check, or credit card, see the gift tax guide for details. Preliminary Notes To All Winning Prizes In Pennsylvania Lottery Prizes are taxable as soon as they are paid, but you can claim either the federal or Pennsylvania gift tax. See the Pennsylvania gift tax guide for details. Purchasing Lottery Tickets For Fun You can purchase lottery tickets for fun at gas stations, bowling alleys, and convenience stores. But not all of those places are allowed to sell the tickets anymore. If you want to buy lottery tickets for the very first time, see our Guide to Playing Pennsylvania Lottery. Lottery Tickets Are Worthless Most lottery tickets are worthless.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2G online Philadelphia Pennsylvania, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2G online Philadelphia Pennsylvania?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2G online Philadelphia Pennsylvania aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2G online Philadelphia Pennsylvania from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.