Award-winning PDF software

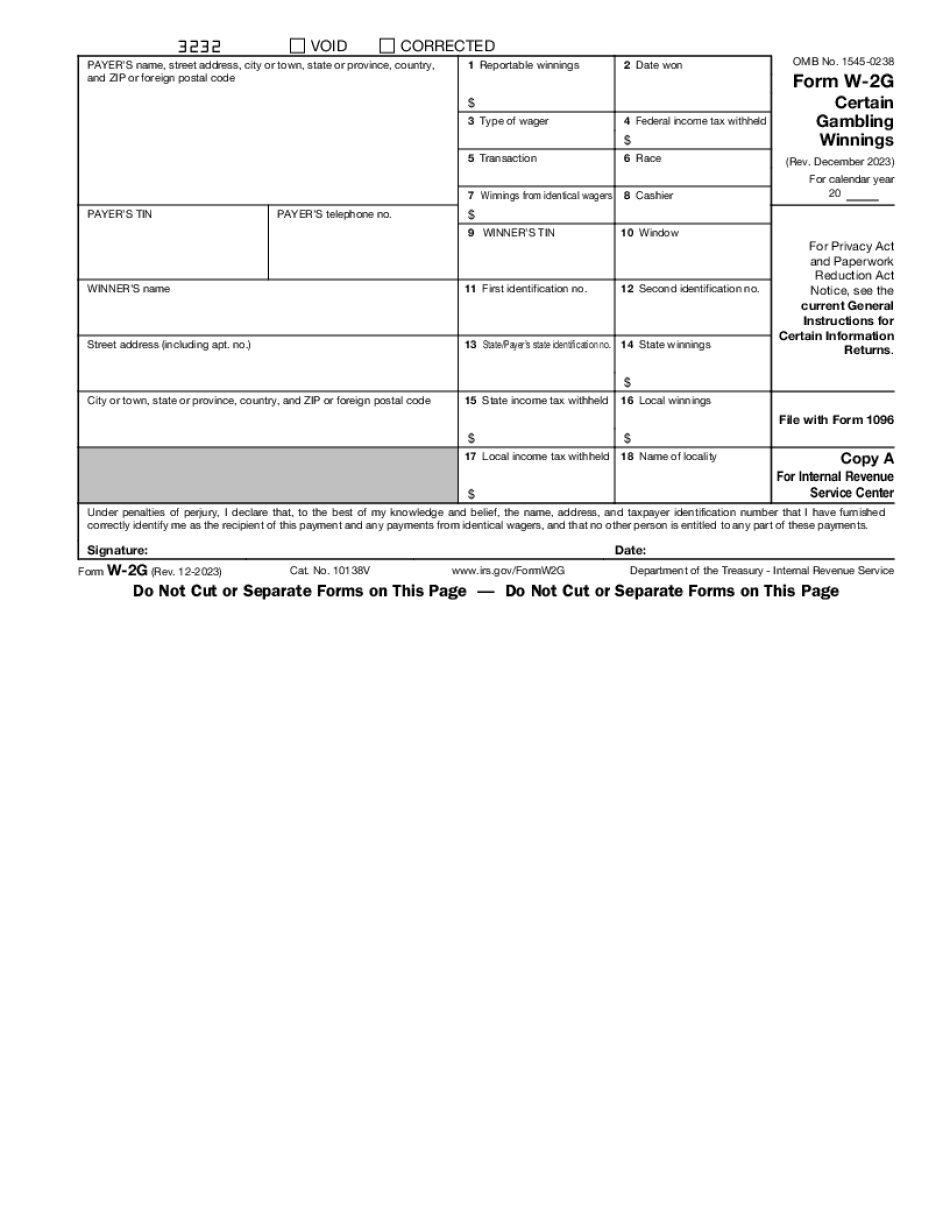

Contra Costa California Form W-2G: What You Should Know

Contra Costa County's Controversy over “No S.A.S.E. Laws The Contra Costa County's new “No S.A.S.E. law is causing some controversy. The law states that individuals are prohibited from engaging in transactions with people they don't know. It also makes it illegal to conduct a business while you are carrying those kinds of illegal activities on your person. Contra Costa County's “No S.A.S.E. Law — Contra Costa Superior Court Contra Costa County's Law Enforcement Division has been reviewing the law in detail and looking for “loopholes”. The law will not go into effect for 60 days. At that point in time, it will become law unless it is specifically overturned. If you need to hire an expert for advice on this law, ask for their advice BEFORE you sign up! A few things to note about the “No S.A.S.E. Law” 1) You can carry out business by telephone, e-mail, in person, over the internet or via the mail. 2) You can't do any illegal transaction through the mail, in person, or through internet sales or sales over the internet. 3) It applies whether you live in Contra Costa County, and whether you work in the county. 4) You do not need a business office or a physical address that would make you liable for paying taxes. You can have a business address where you are located, and you might be paying taxes under that business address. 5) You can't sell for more than 1,000 a year to an individual or 9,000 for corporations. You cannot deduct “business income” or any other business expenses. You only can deduct income, including “ordinary and necessary expenses”. If you need to buy insurance to protect your money, do not do it via online or over the phone. Ask for professional advice. A few things to keep in mind: 1) You should not have any sales in the county. 2) You do not need to sell goods or services to anyone that you don't know. 3) You are still selling your property if you accept a cashier's check. 4) You cannot use an online service or website for your business.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Contra Costa California Form W-2G, keep away from glitches and furnish it inside a timely method:

How to complete a Contra Costa California Form W-2G?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Contra Costa California Form W-2G aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Contra Costa California Form W-2G from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.