Award-winning PDF software

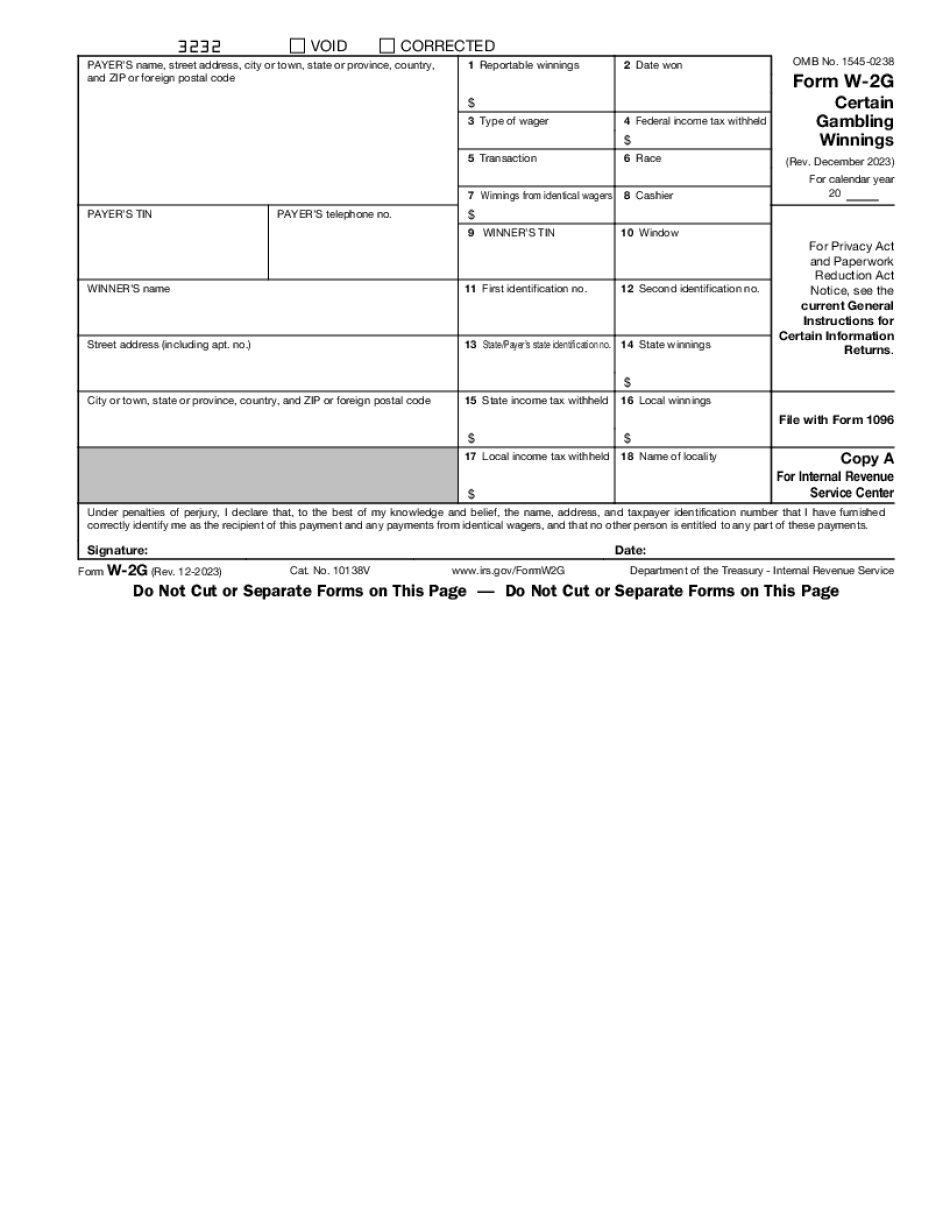

Waco Texas online Form W-2G: What You Should Know

Get a list of the forms and publications needed to complete the form. E-filed Income Tax Return — Fort Wayne Indiana Income or Sales Tax return or Form 1040. If you make a small payment or have any questions, see the Income Tax Questions for Fort Wayne page. Tax-free Interest on the balance. Get the latest Financial Assistance for Free (FAF) Interest on the balance! FAF is a program of the National Free Community College Network (NF CCN) that provides grants up to 2,500 to qualified students. Students at qualifying public institutions of higher education who are residents of Kentucky, Pennsylvania, Tennessee, or Virginia, and attending programs of study as described in 26 U.S.C. Section 530(a)(3) are eligible for one or more such grants as described below. Interest from any amount in excess of the maximum amount allowable, as determined by the terms of your financial aid agreement, may qualify you for a FAF award. The form is designed to simplify the collection of income tax on the amount of interest you receive on the balance in your loan. FAF provides a way for you to qualify for a FAF award for a balance in your loan you have earned. You may also apply for federal grants, as described in 26 U.S.C. 530(a)(1) and (a)(2), for interest you have earned on the balance in your FAF loan by completing the FAF Interest for a Balance Form and submitting it to the IRS. To view information on student loan interest, apply for loan-related grants and find the latest Free Tips for Students on the NF CCN website, go to Student Loans for Free. You have to wait for 4 years to get the balance back. The IRS is not allowing you to deduct interest income on the loan balance above the maximum allowed. You will have to wait until you pay back your loan before deducting or repaying the remaining balance on your balance. E-filed Schedule P, Form 1040 Schedule P You must file a Schedule P, Form 1040, Income Tax Return as soon as possible after the date of death. If you had taxable compensation, you cannot take the benefit of a refundable tax credit and should file a Form 1040X with income tax withheld on your return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Waco Texas online Form W-2G, keep away from glitches and furnish it inside a timely method:

How to complete a Waco Texas online Form W-2G?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Waco Texas online Form W-2G aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Waco Texas online Form W-2G from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.