Award-winning PDF software

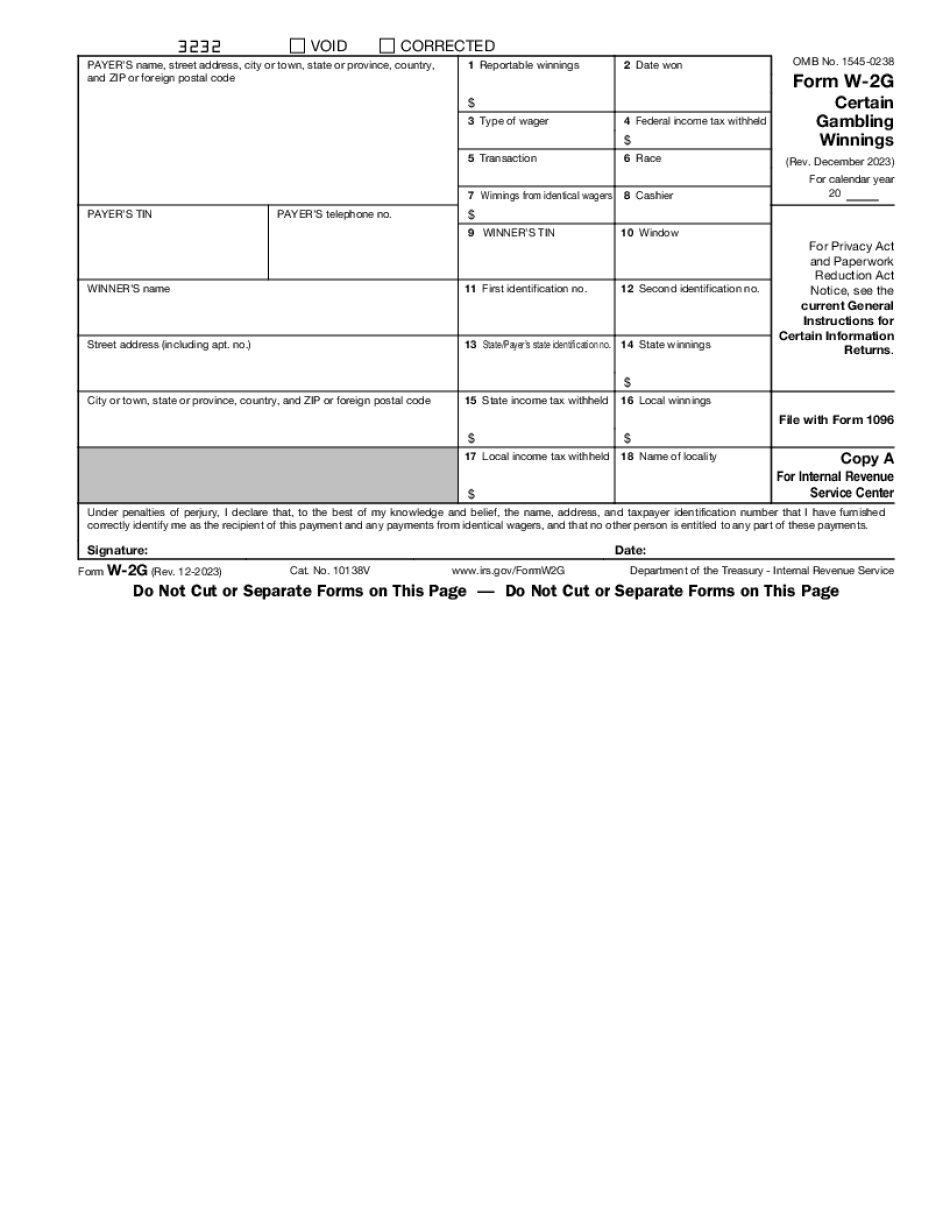

Santa Maria California Form W-2G: What You Should Know

If the employee does not claim this income on their taxes, it will be considered taxable income for the employee's state and local taxes. Most states add to this income that is not reported on the taxpayer's federal income tax return—that was a bonus for me to figure out how much money I owed in taxes! Now if I had paid only my Santa Maria taxes, I would have had to pay income tax of 4,160 that year. Now consider how much was withheld from my paycheck. With 9,500 of federal and California taxes withheld, my total tax payment for 2025 was 17,900. And that left about 12,900 cash. Now that left a little over 11,900 in my checkbook to buy candy! So what had I paid in income tax? As you might expect, I think I paid more than I should have, and now I have some candy. So I think we can work something out. Next Steps In this section I will list some next steps you can take when you have lost your hard-earned candy money. And to keep the post interesting I will add a few stories from my own experience. To try to recover all of your candy money, go to my free Candy Addiction Kit to find a way to use up all the coupons and rewards from Candy.com, and start tracking how much has sold with my free candy addiction kit. A great idea if you are about to get out of Santa Maria. There are lots of places in the world, including the U.S., that will buy your lost candies without the cost of a check or tax filing. And now you can be prepared when that eventuality happens. So, what if I need more help, how can I get help? Contact me at be my personal customer service representative! Let me know if I'm way off base, I don't have all the answers, and what I can do to help you.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Santa Maria California Form W-2G, keep away from glitches and furnish it inside a timely method:

How to complete a Santa Maria California Form W-2G?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Santa Maria California Form W-2G aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Santa Maria California Form W-2G from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.