Award-winning PDF software

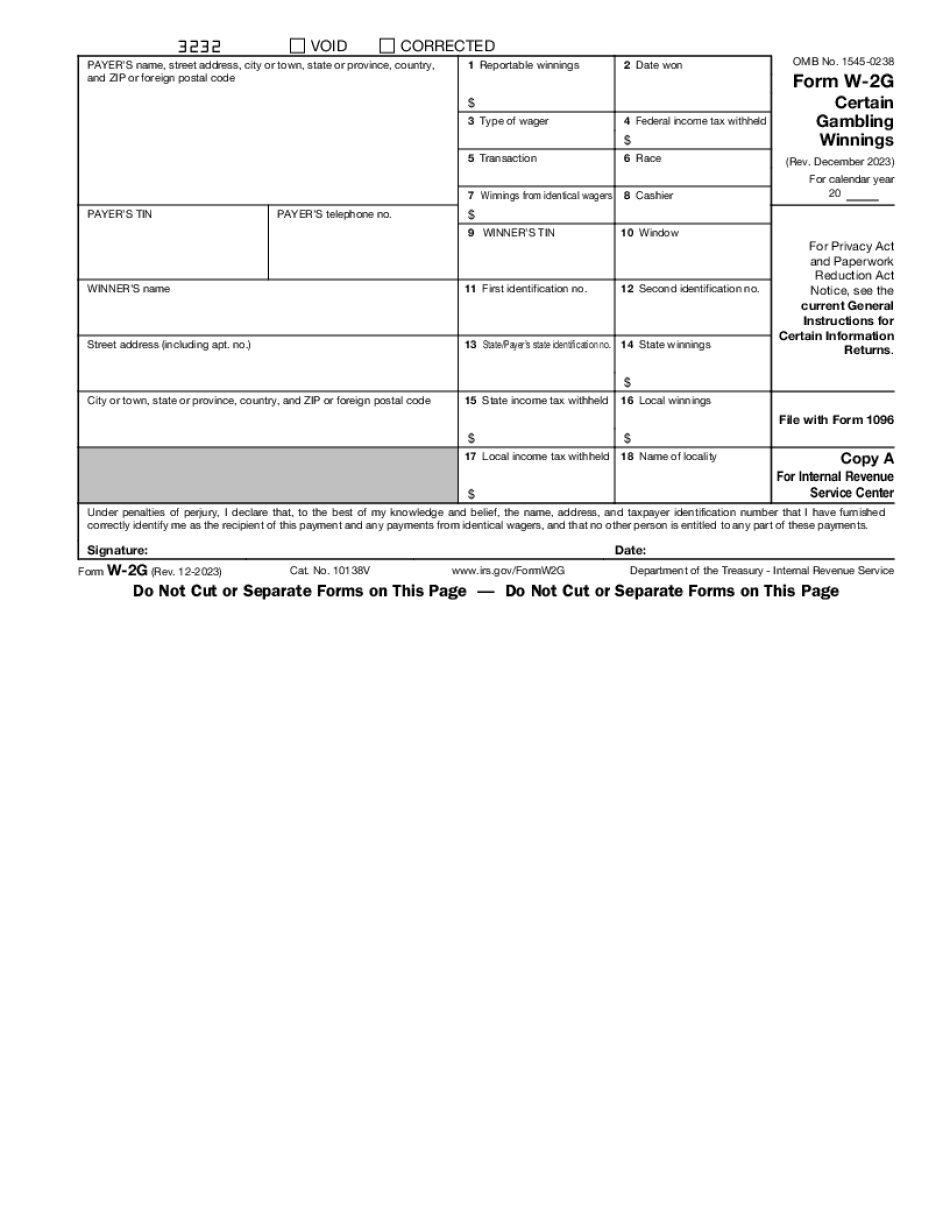

Printable Form W-2G Long Beach California: What You Should Know

Enter your net profit in box 3. Enter the number of Forms W-2G included in line 3a. Enter any special information (see below) on line 4a. Enter the amount of capital investment. 2021 Corporation Tax Booklet Water's-Edge Filers | If your corporation did not have a profit and dividend distribution in the last year, make an election for the 10% tax on any distribute profits in the future. See below for the applicable form. Tax Forms 1099 or 5990 of dividends for a tax year to be filed after 2017. Form 1099-B, U.S. Individual Income Tax Return of a Business, must be completed by your corporation. You must check box 2 if you did not have U.S. income taxes withheld or included from your wagering winnings by the 30th day prior to the date of your wagering win. If you checked box 3, you must check box 4. No 1099 or 5990 need to be mailed if you complete and return Form 540, as the Form 540 form is not due for payment until the 30th days after the date of your wagering win. Enter any additional information on line 2a. No special information (such as Box 4) need to be entered on line 2b if Form 540 shows that you have made any taxable distributions from investments in property. Enter the tax on the wagering winnings shown at line 1a. Enter the amount of property in box 13. See box 13 to the right. Enter taxable capital gain income for the year. Tax on nonages received. 2021 Corporate Tax Booklet (2017) Water's-Edge Filers | You should be using a corporation tax booklet if you are reporting dividends to shareholders and have income taxed at ordinary income tax rates. For more information see “Guidebooks for Small Business Tax Preparers.” The 1099, 1099-B and 1099-C forms are for reporting your income but do not need to be mailed. If you receive multiple forms, complete one in advance if you do not send more than one form. You will not need a complete Form 540 to fill out the IRS Form 1099-B, 1099-C, 1099-MISC or 1099-R.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form W-2G Long Beach California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form W-2G Long Beach California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form W-2G Long Beach California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form W-2G Long Beach California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.