Award-winning PDF software

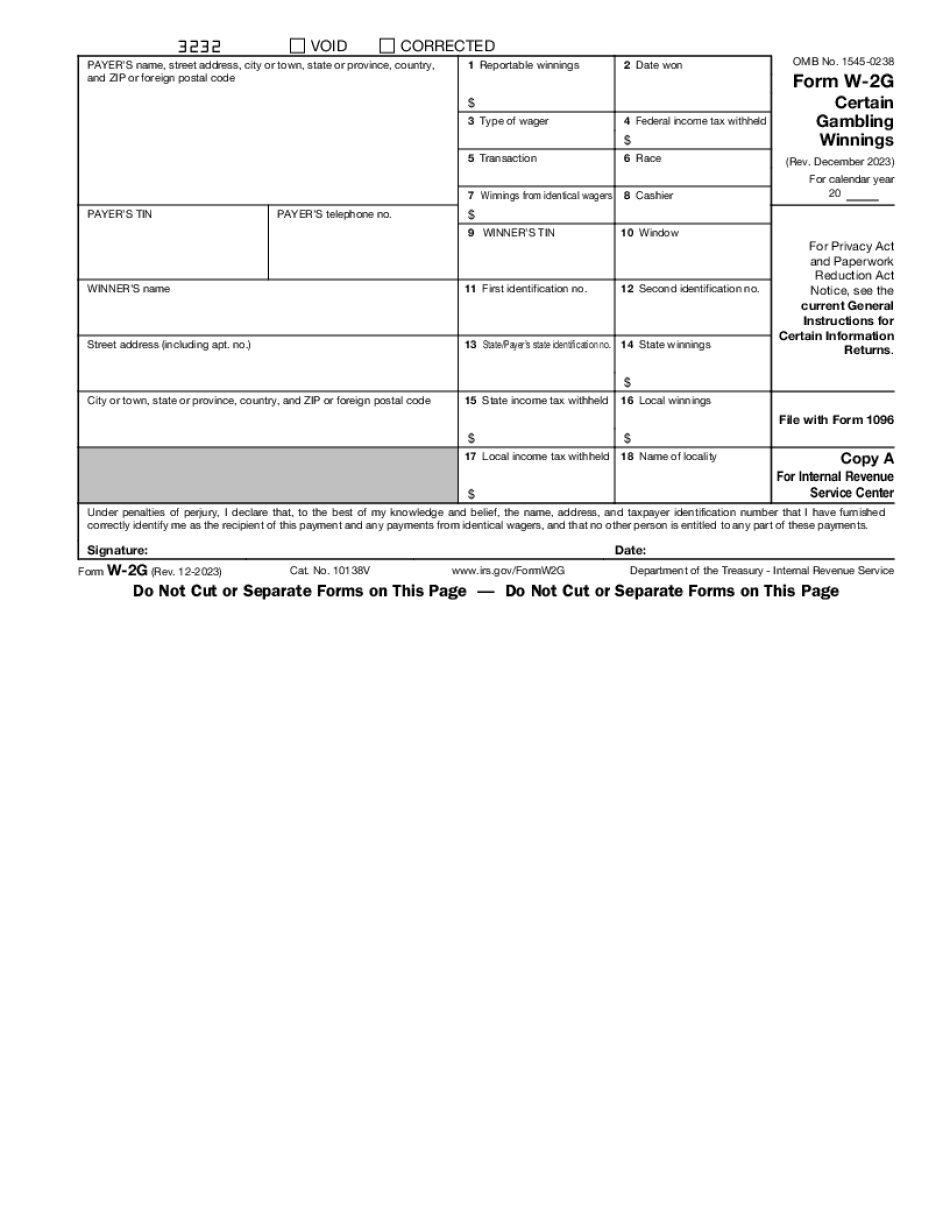

Phoenix Arizona online Form W-2G: What You Should Know

The state has a lottery for money. The lottery has multiple winners. The state has a lottery for taxes. The state has multiple winners. The two are connected. The state is going to run the lottery for the state, but not all the income is going to a common pool. Arizona lottery pays a percentage of income. Most of the lottery income goes back into an insurance pool for a group health plan. Other money goes the general treasury. The only money allocated to the state from the lottery is for the general fund. Every year, they fund a public transportation fund. There's a big difference between the Lottery money and the General Fund. Lottery money is always collected as revenue. The general fund money is just kept in the general treasury. In my opinion, Lottery money should be kept for paying the state's lottery fund. General Fund money could be used for all the state's purposes (taxes not lottery funding, roads, etc.). The only difference between Lottery money and general fund money really is that the lottery money goes to the state for purposes of paying the lottery funds out — and that there's a big difference between the General Fund money and the Lottery money. Lottery money is always collected as revenue, and has to be spent as a one-time expense. The General Fund money goes toward expenses for the current year. If you have to pay taxes on all a particular amount, you choose the amount where taxes are a percentage of the amount. If you have to pay taxes on every last dollar, you choose the smallest amount. The only difference between the Two ways of using lottery monies is the cost of collecting and processing each lottery tax return. Every year, the lottery money goes to the state to be spent on whatever. It might be on public transportation or education. The Governor sets aside money for certain projects. State law says that the money must be appropriated after the lottery money is collected. The Lottery Money Goes In The General Fund. It Does Not Go Into The State General Fund. I'm not going to tell you exactly where the Lottery Money goes, because I don't know all the specifics. It could be the lottery tax money goes back to a special fund for roads, and the state uses that money for public transportation or education. That's the only thing that I know about how the Lottery money is used for general purpose (state and federal) purposes. I'm not going to share that.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Phoenix Arizona online Form W-2G, keep away from glitches and furnish it inside a timely method:

How to complete a Phoenix Arizona online Form W-2G?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Phoenix Arizona online Form W-2G aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Phoenix Arizona online Form W-2G from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.