Award-winning PDF software

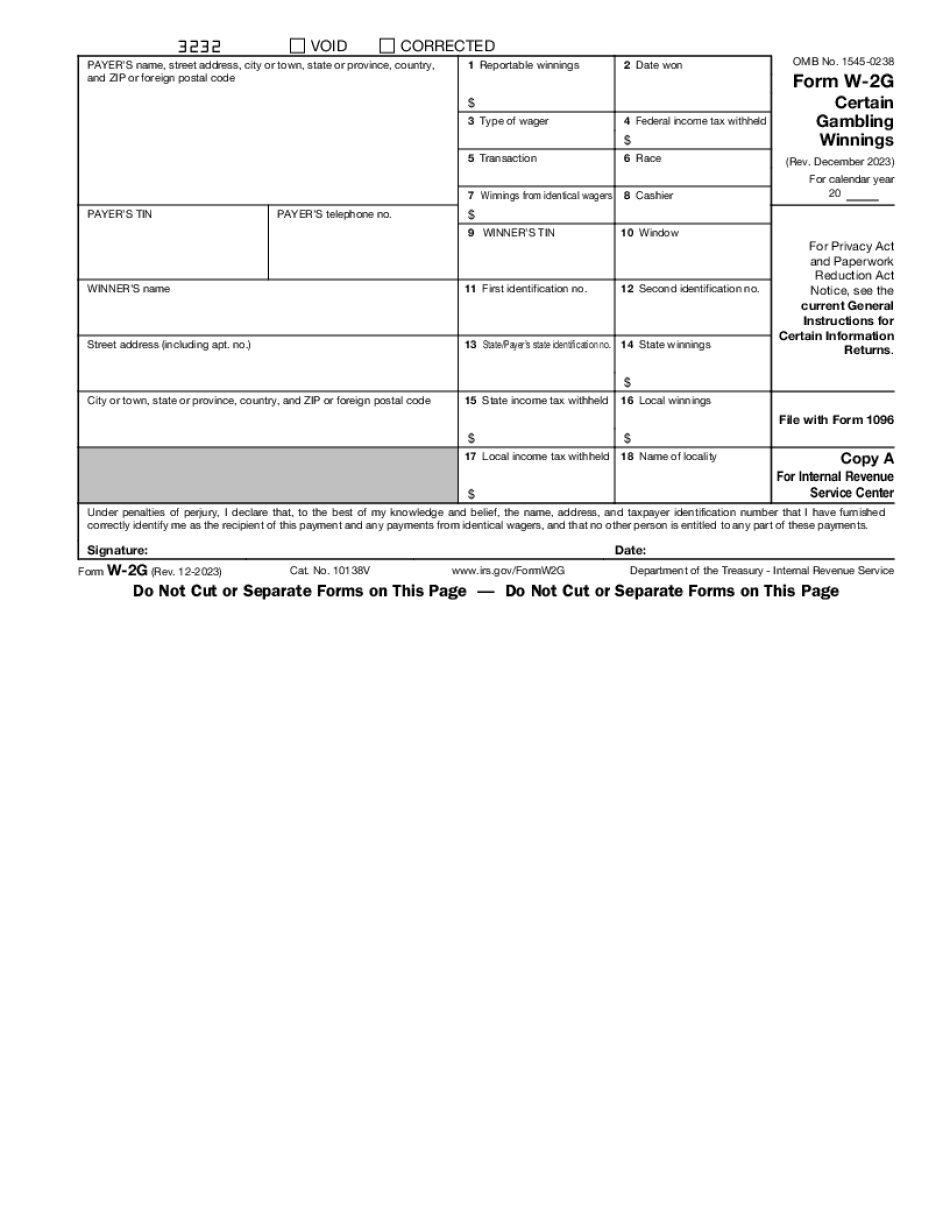

Lakeland Florida Form W-2G: What You Should Know

Enter the number of Form 1099 included. Enter the number of Forms W-2G included in line 11. Enter the number of the Form 1099 included in line 16. Enter the number of the Taxpayer Identification Number (TIN) included in line 23. Enter the Taxpayer Identification Number (TIN) of the person who did not file, provided on line 24 and entered on line 26 of Schedule C (Form 941) and on line 27 of Form 941-A. A NOTE OF FITNESS FOR SERVICES REQUIRED. (Filing Instructions, Form 941, line 4, IMPALA, section 101(b)) B Enter TIN son lines 1 and 2 of schedule C (Form 941) and on line 28 of Form 941-A. If, for any reason to be determined by the Commissioner, an applicant has not reported and paid taxes, the applicant shall provide proof that he or she has been physically present in the City or County of Las Vegas for more than 30 days during the period of the required absence. (See instructions), and if the applicant's business activity does not include a significant volume of trades, sales, or contracts, the applicant shall provide proof that he or she has an active business activity in the City or County of Las Vegas. (See instructions), and if the applicant has been a resident of the State of Nevada for more than 12 months, provide proof that the applicant has no intent, to remain in the State of Nevada for other than business purposes, during the period of required absence. (See instructions), and if a Form W-2 is an amended return for a person (see line 29 of schedule C (Form 941) and on line 27 of Form 941-A), the Form W-2G shall be completed for that person; and B. EXCEPTIONS. B.1. Exceptions. A Form 1099 from which a credit or refund is allowed, for any amount reported on Schedule C (Form 941) and on line 27 of Form 941-A, is subject to the general exception to all deductions for which a person may claim an allowance on Form 1042. However, Form 1099 for this purpose does not include: A Form 1099 from which a credit is allowed for amounts the IRS determines should be added to gross income, a credit for which a person can claim an allowance on Form 1042. OR B.2. Other Exceptions. B.2.1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Lakeland Florida Form W-2G, keep away from glitches and furnish it inside a timely method:

How to complete a Lakeland Florida Form W-2G?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Lakeland Florida Form W-2G aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Lakeland Florida Form W-2G from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.