Award-winning PDF software

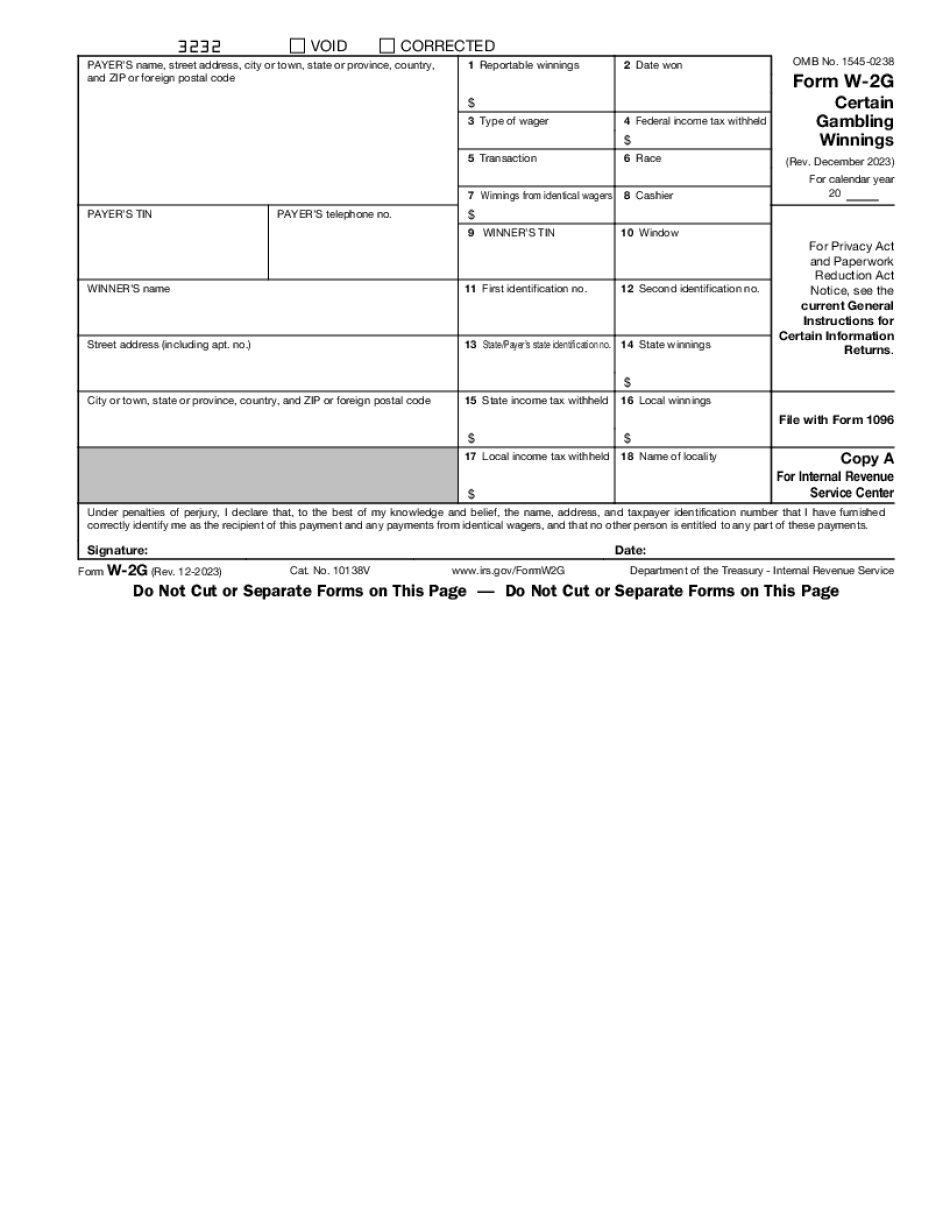

Fort Worth Texas online Form W-2G: What You Should Know

How to Use The W-2G Tax Form to Claim Property Gain Aug 16, 2025 — Beginning July 1, 2018, the U.S. Department of Veterans Affairs will no longer recognize property gains. A homeowner will be considered the owner of an interest in their home during the tax year in which the homeowner purchases the home and will receive a W2G from the casino. How to Report Gaming Revenue Nov 1, 2025 — The U.S. Department of Treasury is making changes to the reporting requirements for gaming revenue. All property that is not used to make operating losses on gaming or is not consumed at a gaming establishment will be reported on Form 5500 Schedule B. For more information, see Publication 559 “Income Tax.” In addition to receiving Forms W-2G about the casino or other payer, you can use the following forms to claim gambling winnings from casinos and other payers: Form 3122 Gambling Winnings — U.S. Department of the Treasury The Form 3122 is provided to the winner and is used for reporting state sales and occupancy tax and gross receipts tax on the revenue from gaming. Form W-9W You may still use the Form W-9W G, Certain Gambling Winnings in the Virgin Islands. This form does not provide information about the casino or other payer. To be eligible to participate, you must have your identification number on file. About “Gambling Winnings” Aug 18, 2025 — The U.S. Department of Treasury will discontinue the use of “gambling winnings” to mean the revenue from slot machines and video poker machines. Previously, a casino that was not a qualifying casino or payer was generally allowed to report “gambling winnings” on its income tax return. The rule stated that a “designated business use” test was required, and the casino did not meet the test. In a few circumstances the casino was allowed to use “gambling winnings” in the past. For these reasons, the term “gambling winnings” is no longer accurate. As of August 2018, casinos will need to use Form W-2G G, Certain Gambling Winnings. Information and Publication on Form 4161 Gambling — IRS To file Form 4161, see Publication 1510. If you are subject to the alternative minimum tax, see Pub 1511.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Fort Worth Texas online Form W-2G, keep away from glitches and furnish it inside a timely method:

How to complete a Fort Worth Texas online Form W-2G?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Fort Worth Texas online Form W-2G aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Fort Worth Texas online Form W-2G from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.