Award-winning PDF software

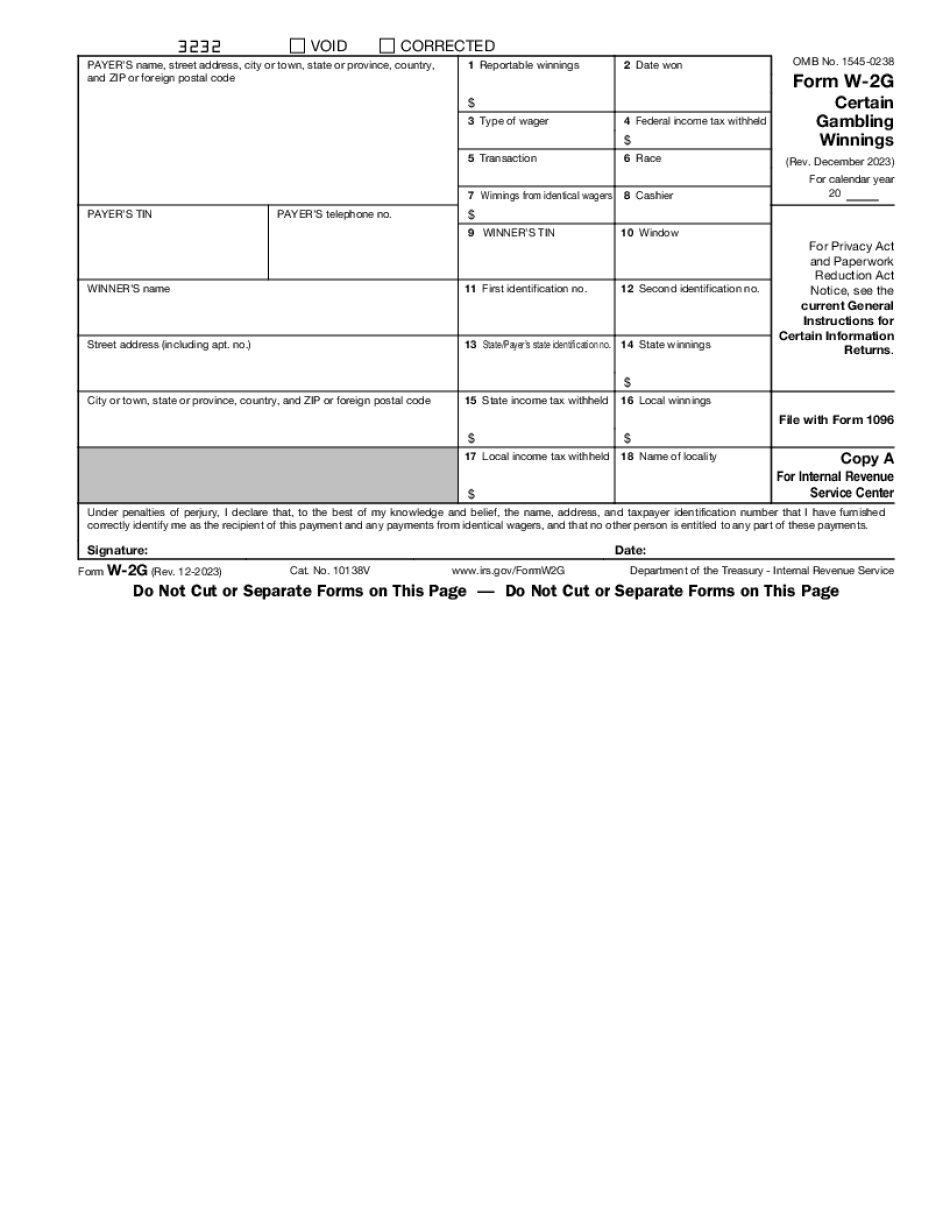

Form W-2G Sandy Springs Georgia: What You Should Know

For the following tax year: IRS Form 990 Withholding for Nonresidents, Not a resident of the U.S. A United States resident claiming tax on foreign sources who must file a U.S. return with the IRS in order to be subject to the withholding tax, has made a significant business change for the tax year, and has substantially decreased the gross income for its U.S.-source income from previous years. If… read more. For the taxes on this year's Form 1099-B entered in line 1b of the 1099-B. In addition, attach to Form 1099-B a check or draft for the tax in the amount of 1.00% of the tax on the 1099-B for the calendar year. In the case of a tax return being sent, attach a completed Form 1099-B. In the case of a cash payment, the cash amount must equal at least the amount set forth under “Amount to be… read more. If your 1099-B entry indicates a capital gain from the sale or exchange of a capital asset (e.g., stocks, mutual funds, private stock) that is more than 250,000, you may be subject to an additional tax. See the instructions for your form for the tax on the capital gain. For Nonresidents, Form 2310A with W-2G Enter the number of Forms W-2G included in line 1a. 3010 EASTER NECK RD, NEAR STANTON, NV 89350 FERRY ROAD, SEATTLE WA 98134 NOTE: For residents of Virginia, please complete Form 709. For residents of Texas, please complete Form 5498, Schedule C. In most cases, you should complete both forms. For residents of Delaware… read more. For nonresident aliens, attach to Form 2310A, nonresident aliens who are U.S. residents and subject to tax by the U.S. On your 1099-B entry and in any attachments, indicate on Form 2310A whether the nonresident alien in Part A paid or received income in this country… read more. For nonresident aliens, Form 6166 (A) with IRS Form W-2G. Note: This form will be mailed separately from the Form 2555 (W-2C) for nonresidents.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2G Sandy Springs Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2G Sandy Springs Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2G Sandy Springs Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2G Sandy Springs Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.