Award-winning PDF software

Form W-2G Irvine California: What You Should Know

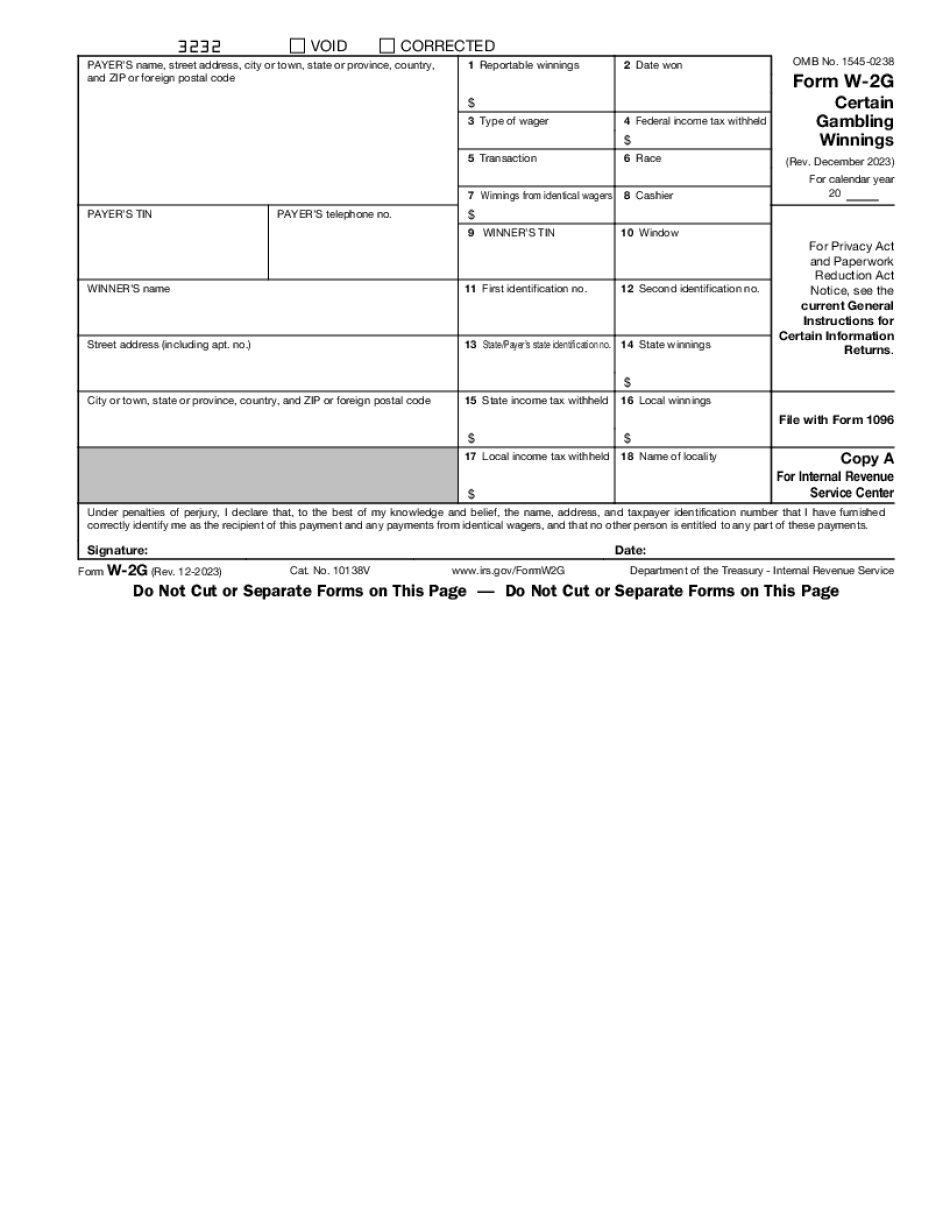

You will show the amounts you received in box 1 of Form W-2G, and you will also show the amount withheld, for federal income tax purposes, in line 2a of your Form W-2G. You may want to file this form if you: 1. Have received any federal income tax withheld on winnings or proceeds from winnings during the year or 2. Are having trouble calculating the amount you owe for taxes because you don't know the exact amount you won. If you are having trouble, or if you want to amend your form, you will need to take a look at the page on the Form W-2G called “Tax Information” on the inside cover. See the section on “Tax Information” on page 33 of the Form W-2G. You'll be able to make corrections or amend, change, or add items from the information page. If this form shows federal income tax withheld in box 4, attach this copy to your return. This information is being furnished to the Internal Revenue Service. The most recent version of this Form W-2G is for the year 2008. It is not appropriate to use it for 2025 or 2014. The form is only available from Investopedia. Tax Exemption for Employee Winnings — IRS Tax Exemption for Employee Winnings — If you are a non-profit organization, an organization that has a regular IRS Form 990 filing, and had winnings during the year from a lottery, or a lottery-related venture, and the total payout at the end of the year is more than 200.00, you may be eligible for an exemption. The form includes a form 1099-G. (This is an IRS form that you can submit to report your winnings so that they can be included in your taxes.) There is another form to file for the employer of the owner of the lottery winnings. (It is called Form 8960.) Taco Bell Foundation Winnings Return — eSmart Tax Form W-2G: Certain Gambling Winnings — IRS If you are a non-profit organization, an organization that has a regular IRS Form 990 filing, and had winnings during the year from gambling activities and any state or local taxes were withheld, you may be eligible for an exemption from federal income tax. See the IRS form at the top of the smart Tax page.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2G Irvine California, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2G Irvine California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2G Irvine California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2G Irvine California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.