Award-winning PDF software

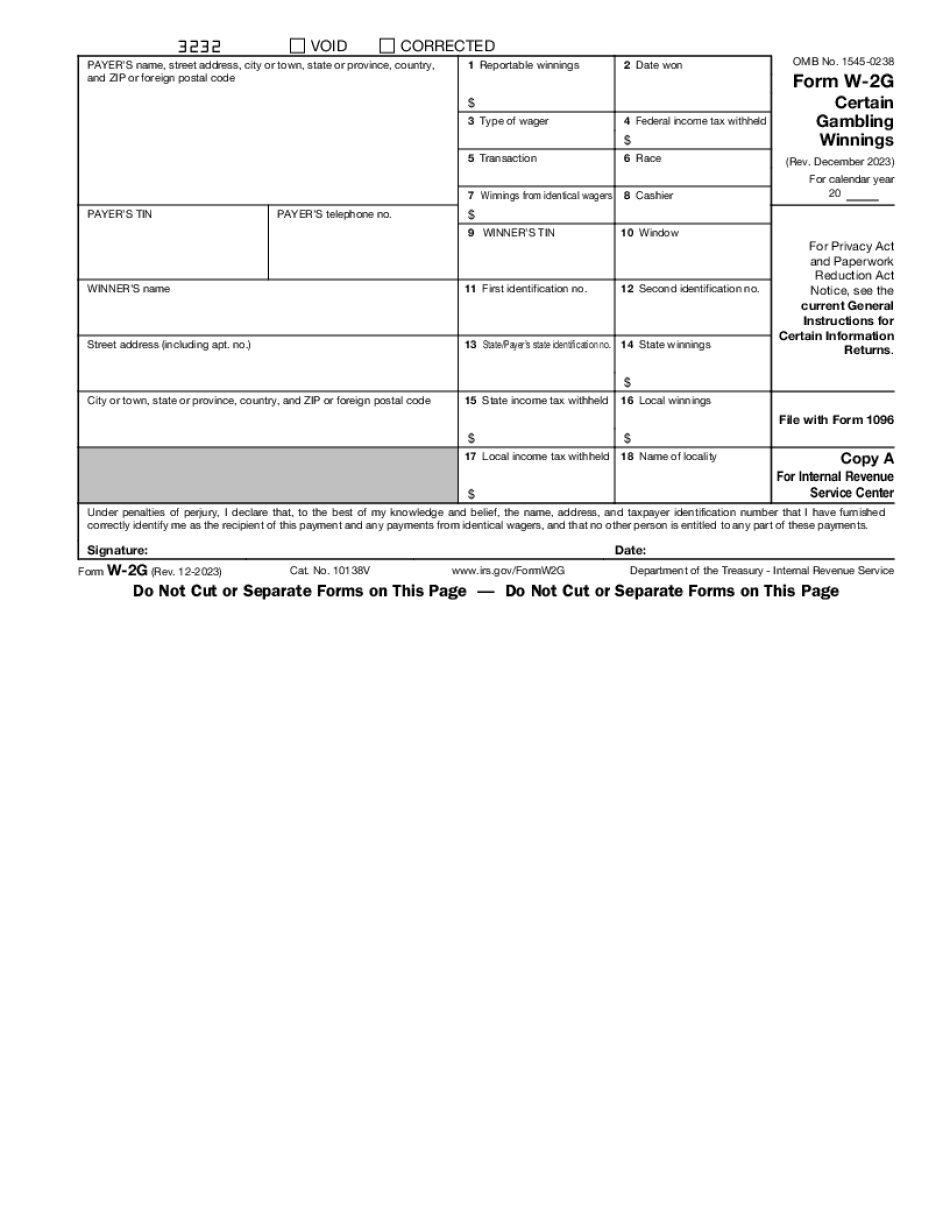

Form W-2G for Hollywood Florida: What You Should Know

Why would I need to file to report? You are required to file for income tax withholding on income or gain derived from the activity listed on your RaceTracks.com casino business statement. If you want to maximize the amount of income you can report, you should have a good understanding of all the requirements so that you don't have to contact an accountant or tax specialist for any additional work. What do I need to do to get Form W-2G? If you are required to file Form W-2G to report income, see my Tips for Getting Your RaceTracks.com Casino Business Statement or contact your casino directly. Why is the W-2G so important? Because it shows which state and local gambling income is subject to income tax withholding and which income is subject to self-employment tax. What is a racetrack? A racetrack is a facility that hosts races; typically, a track runs track events, such as NASCAR and IZOD, as well as other sports and gaming. The purpose of racetracks is to facilitate horse and motor racing at a profit, without the need of using horses, motor vehicles, or other expensive equipment like stands, track surfaces, and electrical wiring. How do I fill out Form W-2G that I receive from RaceTracks.com? You need to fill out Form W-2G as a separate Schedule H (with your RaceTracks.com business certificate) and attach it to your tax return. What do I do if I received a 100.00 win? Make sure you use the correct form. Why am I required to report this win? By applying for a W-2G, you are giving the IRS permission to withhold from your income tax returns any race winnings and other income that exceeds your tax withholding for your regular personal income tax liability. What is the difference between this race winnings, and income from another source? There are several differences between this race winnings, and money that you could receive from another source. For RaceTracks.com, it is a race winning, not an income tax refund! Example: John and Mary are married and have two children, Elizabeth and Samuel Jr.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2G for Hollywood Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2G for Hollywood Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2G for Hollywood Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2G for Hollywood Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.