Award-winning PDF software

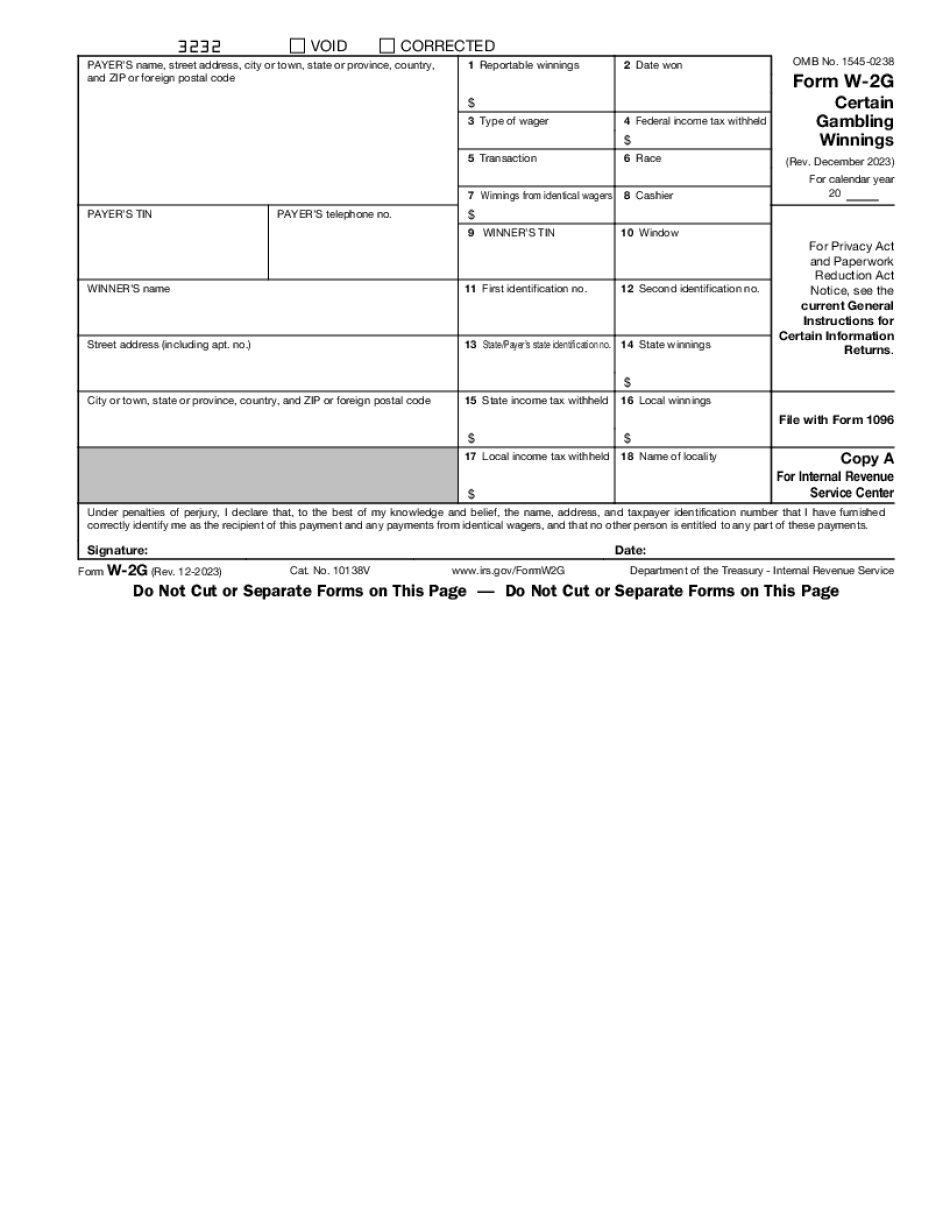

Form W-2G Arlington Texas: What You Should Know

If you are a U.S. resident or a nonresident alien with income from a foreign source but from which you receive U.S. tax taxation on a lesser amount, report the foreign tax on this Form W-2G Sep 17, 2025 — You may be subject to a withholding tax from your wagers on table games like roulette, craps and craps games but not from bets on sports, such as poker or bridge. You also may be asked to pay tax at source. For a gambling business, see Form W-8 and Form W-2. How to Report a Gambling Winnings Tax Tip Report your gambling winnings as regular wages on Form W-2 and attach any withholding remittances to pay taxes on them. As a foreign resident, you may have to pay U. S. taxes on your winnings in the following cases. Determining Your U.S. Tax Status In general, nonresident aliens can qualify for a U.S. tax treaty exemption from U.S. income tax on foreign source income when they earn more than the treaty exemption amount. For details, see What You Need to Know about Income Tax Treaties with Different Countries. Nonresident aliens who are residents of Mexico, Canada, Guam, Puerto Rico or the United States Virgin Islands, and who do not receive the treaty exemption amount, must file Form 3949 to report income from gambling activities on their U.S. federal income tax return when they earn more than the lowest amount that meets the following conditions: Form 3949, Nonresident Alien Income Tax Return, and attach these forms to your income tax return each year. If you are filing your return jointly with a spouse, report on Form W-2G, Certain Gambling Winnings of Multiple Persons. If you are filing for a child, report on Form 1040EZ, U.S. Individual Income Tax Return for Children Under 21 Years, and attach these forms to the child's income tax return each year. For more information, download the following brochure: The form and instructions will help prepare you for your annual U.S. income tax return. The U.S. tax system offers significant benefits, and you must be aware of these opportunities.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2G Arlington Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2G Arlington Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2G Arlington Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2G Arlington Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.