Award-winning PDF software

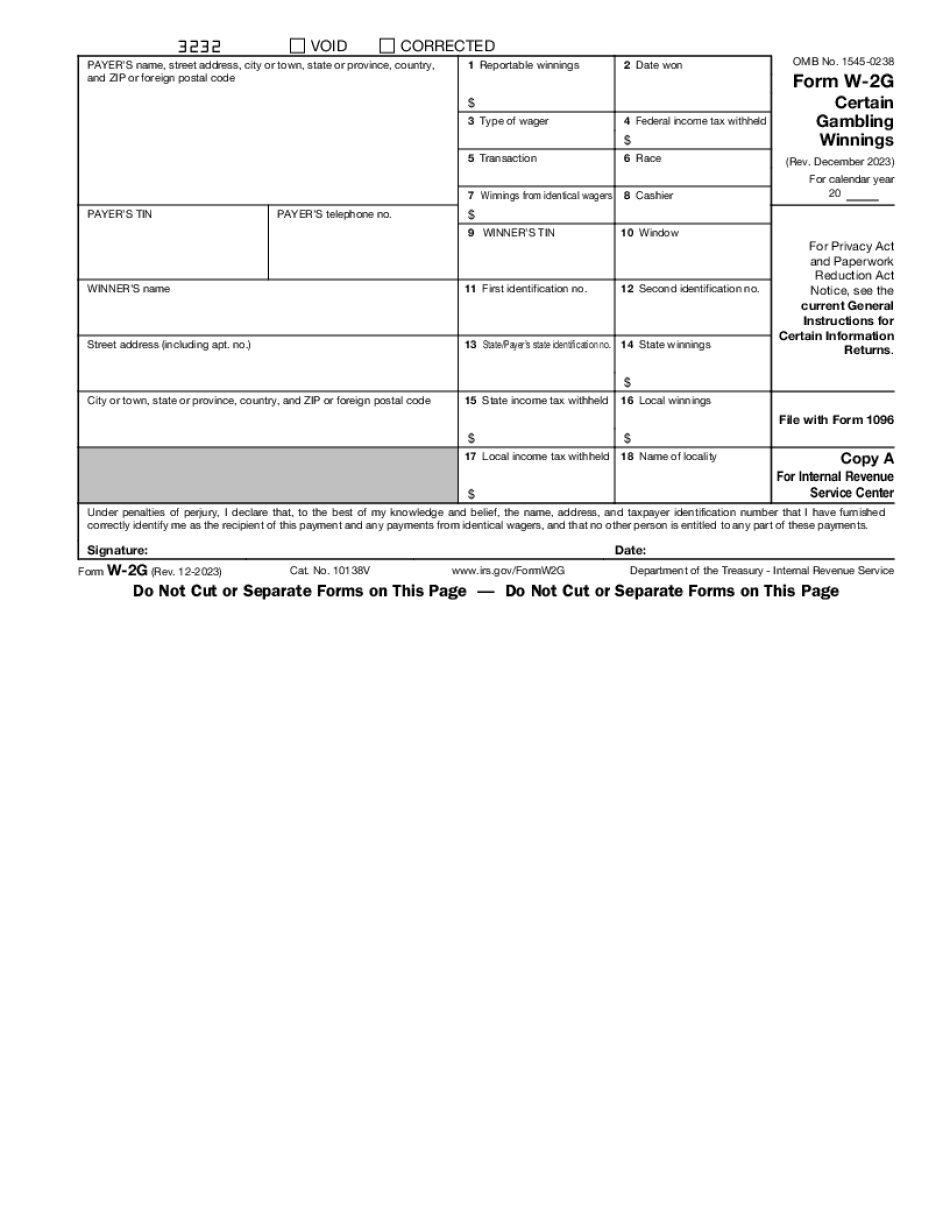

About form w-2 g, certain gambling winnings - internal revenue

Where the Form 706 is filed. If we are an S Corporation. If the Form 706 is filed by a partnership, the requirements are different. For more information on the forms that may be used to report gambling winnings, please see the links below. Please note that the federal tax credit may be a credit toward the tax liability when you file your tax return. See IRS Publication 502, Credit for gambling winnings.

form w-2g (rev. january ) - internal revenue service

For more information, see Publication 590-A, Tax Guide for Individuals. Q. Will I owe income taxes when I'm in the for any amount of time? A. Yes. If you're subject to the alternative minimum tax, you'll owe federal income tax on any earnings. For more information on the alternative minimum tax, see Publication 501, Tax Guide for Individuals. Q. If my employer withholds income taxes from my wages when I'm on vacation, do I end up owing any income taxes? A. It depends. Residents are not subject to income taxes when they are abroad on vacation as long as they are either: A resident of a foreign country or possession of the United States; or. Living in the , for less than 183 days, on the taxpayer's income tax return for the calendar year in which such income is earned. For example, if a foreign employee is a resident and works for employers for.

Form w-2g: certain gambling winnings - investopedia

As an individual filer, you need only make this W-2G. As a business owner or employee, you must check the W-2G to determine whether you're required to make Form W-2G. For more information, see Businesses that Employ Minors and the Special Rules for Gambling Winnings, later. For more information, see Pub. 946 to determine whether any other tax laws apply to you. Employees who gambled on other persons' wagers and the profits they earned on those bets are subject to the reporting requirements detailed in the following sections. If you receive an offer to pay money to any of the other persons involved in a gambling activity, it is important for you to consider whether to accept the offer. There are three situations where it is appropriate for you to receive a check or cash amount from the person who's offering the payment. If a bettor's loss exceeds his or her winnings, the bettor.

How to use the w-2g tax form to report gambling income

The federal excise tax, the most widely accepted measure of gambling income, is 15% on the winnings of slot machines, 20% on the winnings of blackjack or baccarat, and 30% on the jackpot. But state governments also impose their own excise taxes. The states with the highest casino taxes are New Jersey, Virginia, Pennsylvania, Maryland, North Carolina, South Carolina, and New York. The highest state tax on winnings is Oregon's, followed by Massachusetts'. But the lowest tax on winnings is in Rhode Island of as of January 1, 2012. Other states have lower winnings tax rates: California's tax rate is ; Illinois' is ; and California is also the only state tax rate that doesn't require the customer to pay the tax, a tax that some other states require an electronic deposit at the end of each day. You need an extensive set of gambling skills to enjoy gambling. With.

Federal form w-2g instructions - esmart tax

For more information on Social Security and Medicare contributions, see the Social Security Guide: Social Security and Medicare Income Taxes If you make 1,000 or more in taxable payroll contributions to eligible retirement or disability accounts in the year: Complete Form W-2G, Certain Gambling Winnings, and Schedule H, Pension or Retirement Income. Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and . . . For more information on Social Security and Medicare contributions, see the Social Security Guide: Social Security and Medicare Income Taxes If an employee is required to file a self-employment tax return even though he or she is not required to complete Form 941, Form 1040, or Form 1040NR, the employee may complete SITAR, which is a substitute form for Form 941, Form 1040, or Form 1040NR. SITAR is not a substitute for Form 941. If an employee.